What is an ISA account?

An Individual Savings Account (ISA) is a tax-free savings or investment account available to UK residents, allowing you to save or invest up to a set amount each year without paying income tax or capital gains tax on the returns. The different types of ISA accounts cater to various financial goals, from safe saving to long-term investing. Introduced in 1999, ISAs have grown in popularity, with UK households contributing a record £103 billion in 2023/24, according to GOV.UK annual savings statistics.

Definition and tax benefits

ISAs shield your money from tax, meaning interest, dividends, or gains grow tax-free. Unlike regular savings accounts, where interest might fall under the personal savings allowance (up to £1,000 tax-free for basic-rate taxpayers), ISAs offer unlimited tax relief. This makes them ideal for building wealth efficiently, especially as Forbes Advisor UK notes their role in avoiding capital gains tax on investments.

Eligibility and residency rules

You must be 18 or over and a UK resident to open an adult ISA, though non-residents can keep existing ones. Children under 18 qualify for Junior ISAs via parents or guardians. The Financial Conduct Authority (FCA) regulates providers, ensuring consumer protection.

Overall annual allowance

The ISA allowance for 2025/26 is £20,000, shared across all types of ISA accounts. This limit resets each tax year from 6 April to 5 April. You can split it, for example, £10,000 in a cash ISA and £10,000 in a stocks and shares ISA. For more on limits, see our guide on what is an isa.

Cash ISAs

Cash ISAs are like high-street savings accounts but tax-free, offering fixed or variable interest on deposits. They suit risk-averse savers seeking steady growth without market fluctuations. In 2025, with inflation concerns, cash ISAs remain popular for their security.

How they work

Your money earns interest (AER, or annual equivalent rate) while staying protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). Options include easy-access for flexibility or fixed-rate for higher yields over set periods. Providers like Lloyds Bank and Virgin Money offer various cash ISAs.

Current rates and examples

As of October 2025, top cash ISA rates reach 4.92% AER, per Tembo. For instance, a one-year fixed cash ISA might pay 4.5%, while easy-access versions hover around 4%. To compare current options, check best isa rates.

Pros, cons, and protection

Pros include low risk and predictable returns; cons are lower yields than stocks in bull markets and inflation erosion. FSCS covers deposits if the provider fails, adding peace of mind.

Tip: If you’re new to saving, start with a cash ISA for its simplicity. Monitor rates quarterly, as they can change with Bank of England decisions.

Stocks and shares ISAs

Stocks and shares ISAs let you invest in funds, shares, or bonds tax-free, potentially yielding higher returns over time. They appeal to those comfortable with market volatility, forming a core part of diversified portfolios.

Investment options

Choose from individual stocks, exchange-traded funds (ETFs), or managed funds. Platforms like Halifax Share Dealing provide access to global markets. Minimum investments start low, often £100 monthly.

Risks and returns

Returns vary; historical averages are 5-7% annually, but capital is at risk—you could lose money. Unlike cash ISAs, no FSCS protection for investments, though FCA oversight applies. Diversify to mitigate risks.

Platform choices

Select based on fees and tools; NatWest ISA options suit beginners. Always review charges before committing.

Lifetime ISAs

Lifetime ISAs (LISAs) combine saving with a government bonus for first-time home buyers or retirement, available to ages 18-39. They blend cash and stocks options, with tax-free growth.

Government bonus details

Contribute up to £4,000 yearly to get a 25% bonus (max £1,000), as explained by GOV.UK. Lifetime bonus cap is £32,000.

Usage for home buying or retirement

Use for homes up to £450,000 or after age 60. Ideal for long-term goals, but stocks versions add growth potential.

Withdrawal rules

Non-qualifying withdrawals incur a 25% charge, reclaiming the bonus plus penalty. Plan carefully to avoid fees.

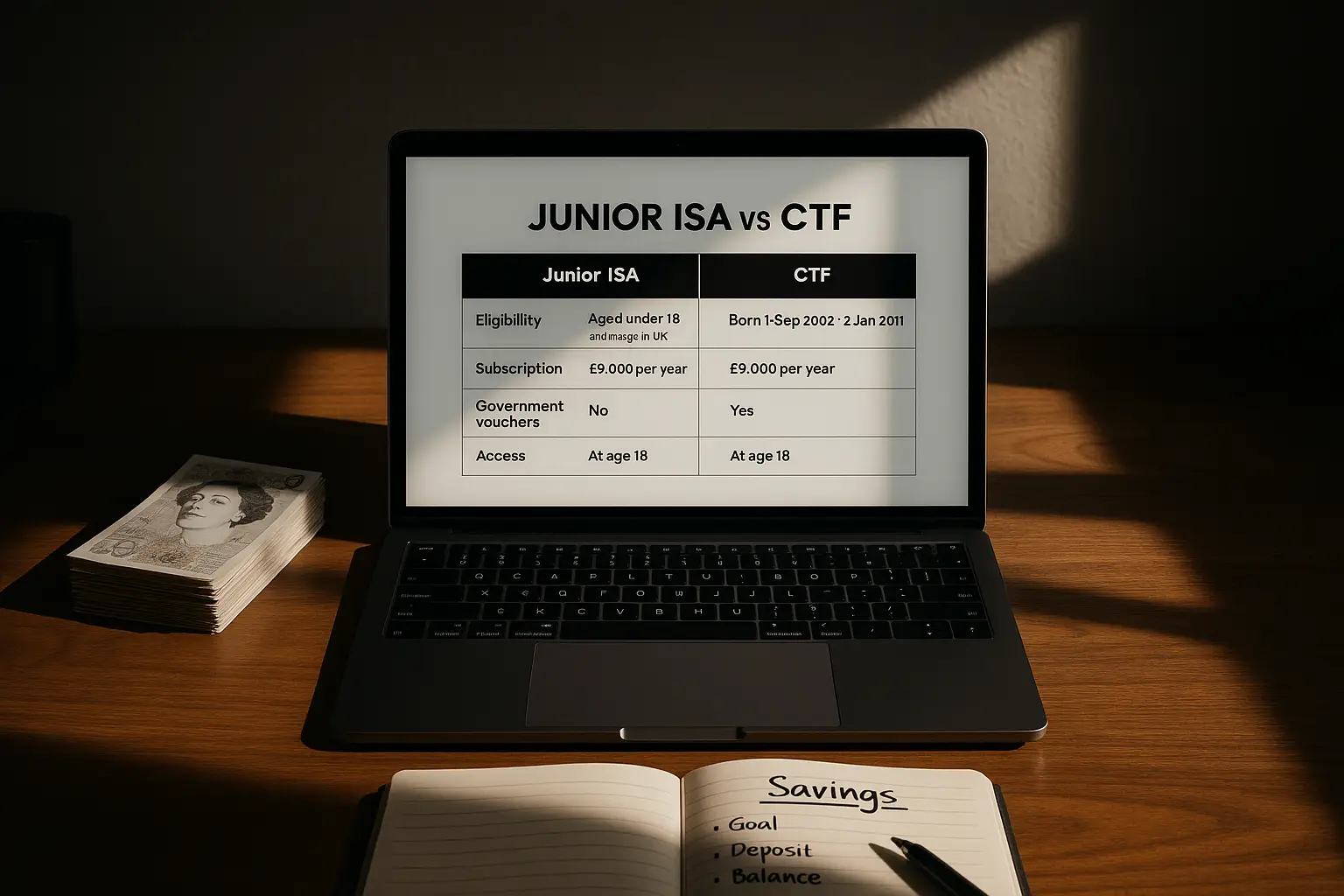

Junior ISAs

Junior ISAs (JISAs) help parents save tax-free for children under 18, with funds accessible at maturity.

For children under 18

Open a cash or stocks JISA; anyone can contribute, but only one provider per type.

Contribution limits

£9,000 annual allowance for 2025/26, separate from adult limits.

Maturity and access

At 18, the child controls it, converting to an adult ISA option.

Innovative finance ISAs

Innovative finance ISAs (IFISAs) invest in peer-to-peer lending or crowdfunding, offering higher potential yields but elevated risks.

P2P and alternative investments

Lend to individuals or businesses via platforms, earning interest tax-free.

Higher risks

No FSCS protection; loans may default. Suit experienced investors.

When to consider

If seeking yields above 5%, but limit to 10-20% of portfolio.

ISA rules and allowances

Understanding rules ensures compliance; you can hold multiple ISAs but subscribe to one per type yearly.

| Type | Allowance | Risk level | Best for | Key features |

|---|---|---|---|---|

| Cash ISA | £20,000 | Low | Safe saving | Interest up to 4.92% AER; FSCS protected |

| Stocks and shares ISA | £20,000 | Medium-high | Growth investing | Tax-free gains; potential 5-7% returns |

| Lifetime ISA | £4,000 (+bonus) | Low to high | Home/retirement | 25% government bonus |

| Junior ISA | £9,000 | Low to high | Children’s future | Tax-free until 18 |

| Innovative finance ISA | £20,000 | High | Alternative yields | P2P lending; no FSCS |

How many ISAs can you have?

No limit on total ISAs, but one new subscription per type per year. Transfers allowed without affecting allowance.

Transfers and withdrawals

Withdraw anytime (flexible ISAs), but lost allowance if not replaced. Transfers keep tax-free status.

2025/26 updates

Allowance stays £20,000; check GOV.UK for how ISAs work for changes.

Frequently asked questions

What are the different types of ISAs?

The main types of ISA accounts UK include cash ISAs for safe savings, stocks and shares ISAs for investments, Lifetime ISAs with government bonuses, Junior ISAs for children, and Innovative Finance ISAs for peer-to-peer lending. Each suits different needs, from low-risk interest to higher-return equities. According to Wikipedia, there are five core adult types, helping users avoid capital gains tax across options.

How much can I contribute to an ISA in 2025?

For 2025/26, the ISA allowance is £20,000 total across all types for adults, while Junior ISAs allow £9,000 and Lifetime ISAs £4,000 plus bonus. This covers questions like can I put 20,000 in an ISA every year—yes, if within limits. Exceeding triggers HMRC penalties, so track contributions carefully for tax-free benefits.

Can I have multiple ISA accounts?

Yes, you can have how many ISAs can I have without limit, but only one new cash ISA, one stocks and shares, etc., per tax year. This flexibility lets you diversify, like a cash ISA with Virgin Money and a stocks ISA elsewhere. Transfers between providers count as one subscription, preserving your allowance.

What is the difference between cash and stocks ISAs?

Cash ISAs offer guaranteed interest with low risk and FSCS protection, ideal for short-term needs, while stocks and shares ISAs involve market investments with potential higher returns but possible losses. Cash suits conservative savers amid 4.92% rates, per Tembo, whereas shares appeal for long-term growth despite volatility. Choose based on risk tolerance and goals.

What is a Lifetime ISA?

A Lifetime ISA is a types of ISA accounts variant for 18-39 year-olds, allowing £4,000 yearly contributions with a 25% government bonus for home purchases or retirement. It can be cash or stocks-based, growing tax-free. Withdrawals outside permitted uses incur penalties, making it a strategic choice for major life events, as detailed by Forbes Advisor UK.

What are cash ISA rates like in 2025?

Cash ISA rates vary, with best cash ISA rates reaching 4.92% AER for fixed terms, influenced by base rate cuts. Easy-access options offer around 4%, per Moneyfacts. For comparisons, including best ISA rates UK, rates beat standard savings due to tax perks but may lag inflation—review annually for optimal yields.

Exploring types of ISA accounts helps align savings with your goals. For the latest deals, visit provider sites or our resources.