Basics of a Junior ISA

A Junior ISA, often abbreviated as JISA, is a tax-free savings or investment account designed specifically for children under 18 in the UK. It allows parents or guardians to save or invest on behalf of their child, helping to build a financial foundation for their future without the burden of taxes on growth. This account is managed by an adult until the child reaches 18, when full control transfers to them.

Eligibility and who can open one

Any child who is a UK resident and under 18 can have a Junior ISA opened for them, provided they do not already have an active Child Trust Fund. Parents, legal guardians, or anyone with parental responsibility can open the account. If the child has a Child Trust Fund, that must mature or be transferred before a new JISA can be set up. According to official guidance on GOV.UK’s Junior ISA overview, eligibility is straightforward to ensure accessibility for families planning ahead.

How a Junior ISA works

Parents contribute money to the account, which earns interest or grows through investments, all tax-free. The funds are locked until the child turns 18, promoting long-term saving. Contributions can come from family or friends, and the account is held with a provider regulated by the Financial Conduct Authority (FCA). In essence, it’s like an adult ISA but tailored for minors, with parents making decisions until maturity.

Differences from adult ISAs

Unlike adult ISAs, which allow withdrawals at any time and have an annual limit of £20,000, a Junior ISA restricts access until age 18 and caps contributions at £9,000 per tax year. Adult ISAs offer more flexibility but require the account holder to be 18 or over. Junior versions focus on child-specific growth, exempt from income tax and capital gains tax, as detailed by MoneySavingExpert’s guide to Junior ISAs.

Types of Junior ISAs

A Junior ISA comes in two main types: cash or stocks and shares. The cash version offers steady, low-risk savings, while the stocks and shares option invests in funds or shares for potentially higher returns. Choosing depends on your risk tolerance and time horizon until your child is 18.

Junior cash ISA explained

What is a junior cash ISA? It’s a savings account where money earns interest, similar to a bank savings account but with tax-free benefits. Funds are protected up to £85,000 per person under the Financial Services Compensation Scheme (FSCS). Interest rates vary, but top options in 2025 offer up to 4% AER (Annual Equivalent Rate, a standard measure of interest).

Junior stocks and shares ISA

What is a junior stocks and shares ISA? This type invests contributions in stocks, shares, bonds, or funds, aiming for growth over time. Returns aren’t guaranteed and can fluctuate with markets, but historical data shows average annual returns of 5-7% over long periods. It’s ideal for parents comfortable with some risk for potentially greater rewards.

Choosing the right type

Consider your child’s age and your financial goals. For newborns with 18 years to grow, a stocks and shares JISA might suit; for older children, a cash one provides stability. A mix via a Lifetime ISA at 18 is possible later.

| Type | Pros | Cons | Risk Level | Sample 2025 Rate/Return |

|---|---|---|---|---|

| Cash | Stable, predictable growth; FSCS protection | Lower returns; inflation risk | Low | Up to 4% AER |

| Stocks and Shares | Higher potential growth; diversification | Market volatility; possible losses | Medium to High | Avg 5-7% historical |

Tip for parents: Start small with monthly contributions to build the habit, even if it’s just £50 a month, which could grow significantly over 18 years.

Benefits of a Junior ISA

The key benefit of a Junior ISA is tax-free savings and growth, shielding earnings from UK income and capital gains taxes. It provides a secure nest egg for milestones like university or a first home, with around 415,000 Child Trust Funds transferred to JISAs in 2024-2025, per GOV.UK savings statistics.

Tax advantages

What is a tax-free Junior ISA? All interest, dividends, and gains are exempt from tax, unlike regular savings where over £1,000 interest might be taxable for basic-rate taxpayers. This maximises every pound saved.

Long-term growth potential

Over 18 years, compound growth can turn regular contributions into substantial sums. For example, £9,000 annually at 4% could exceed £300,000 by maturity, though past performance isn’t a guarantee.

Security for your child’s future

It’s a dedicated pot of money, protected from adult financial issues, ensuring your child starts adulthood with savings.

Rules and contribution limits

The annual limit is £9,000 for the 2025/26 tax year, covering both types combined. Contributions stop at 18, but growth continues if invested.

Annual allowance and maximum contributions

What is the maximum you can put in a Junior ISA? Up to £9,000 per tax year (6 April to 5 April), from any source like gifts. Unused allowance doesn’t carry over, as per Moneyfarm’s rules guide.

Interest rates and fees

What is the interest rate on a Junior ISA? Cash rates reach 4% AER in 2025, per Forbes Advisor UK. Stocks and shares have management fees, typically 0.25-1%, but no tax on gains.

Access and withdrawal rules

Funds are inaccessible until 18, except in terminal illness cases. Early closure forfeits tax benefits.

Age limits and transfers

Available from birth to 17 years, 364 days. Transfers from Child Trust Funds or other JISAs are allowed without affecting the allowance.

How to open a Junior ISA

Opening a Junior ISA involves selecting a provider and completing an application online or in-branch. It’s a simple process for UK residents.

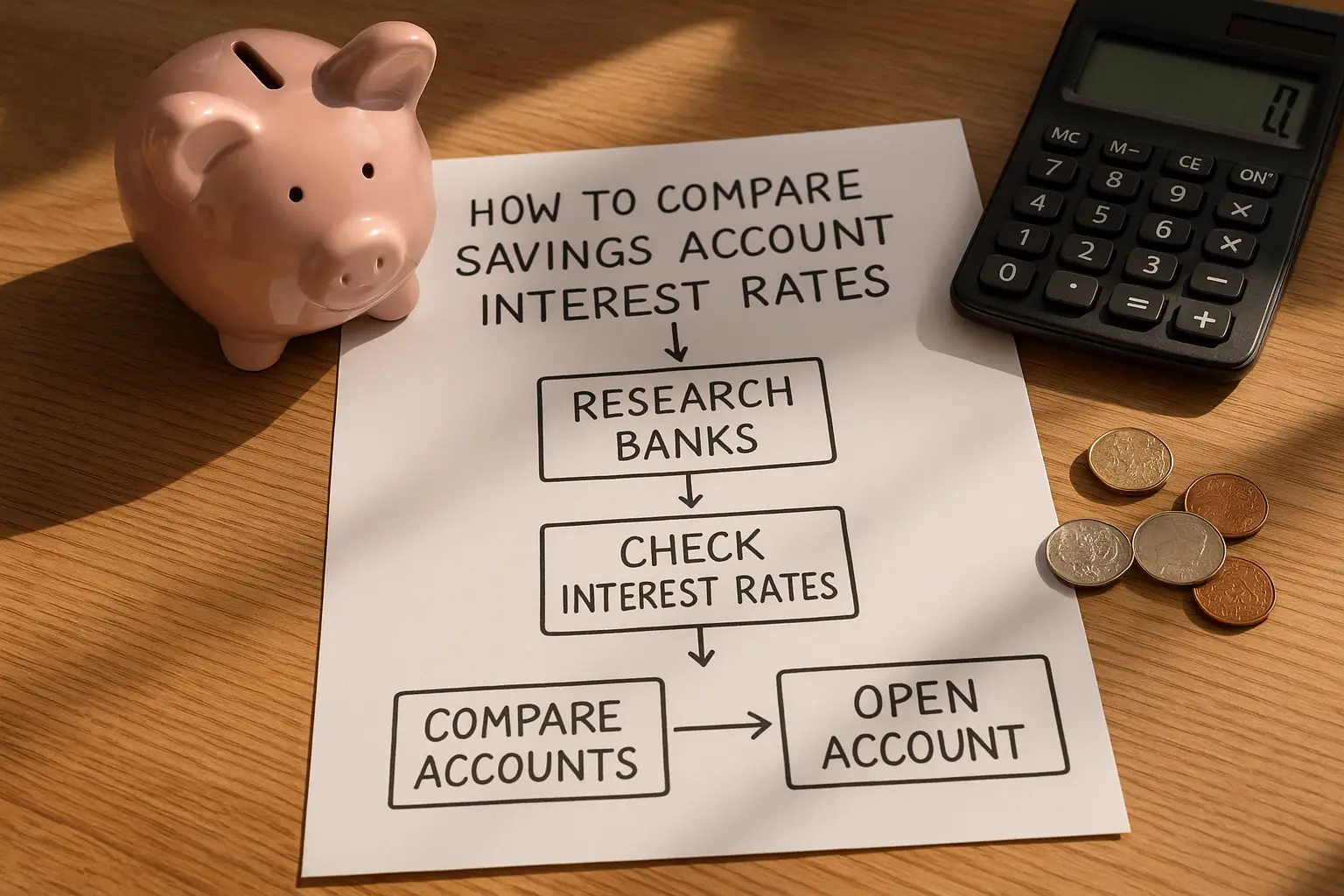

Step-by-step process

1. Check eligibility on GOV.UK. 2. Choose cash or stocks and shares. 3. Compare options via sites like MoneySavingExpert. 4. Apply with the provider, providing child details. 5. Fund the account.

Required documents

You’ll need the child’s birth certificate, your ID, and proof of address. For transfers, Child Trust Fund details.

Popular providers

Options include HSBC, NatWest, and NS&I; details on HSBC’s Junior ISA page. For the best junior isa choices, explore broader comparisons.

Junior ISA vs other child savings options

Junior ISAs stand out for tax-free benefits, unlike taxable children’s savings accounts.

Comparison to Child Trust Funds

Child Trust Funds (CTFs) were similar but phased out in 2011; many have matured, with 415,000 transferred to JISAs recently. JISAs offer higher limits and more providers.

Vs regular children’s savings accounts

Regular accounts allow easy access but tax applies over £100 interest for parents. JISAs lock funds for better long-term tax-free growth. For more on best junior isa vs alternatives, see dedicated guides.

Frequently asked questions

How does a Junior ISA work?

A Junior ISA works by allowing tax-free contributions up to £9,000 annually, managed by parents until the child is 18. Growth occurs through interest or investments, exempt from taxes. This structure encourages disciplined saving, with the child gaining control at maturity to use for education or other needs. It’s regulated by HMRC to ensure fairness and security.

What’s the difference between a cash and stocks and shares Junior ISA?

A cash Junior ISA provides fixed interest with low risk, ideal for conservative savers, while a stocks and shares version invests in markets for higher potential returns but with volatility. Cash suits short-term stability, stocks and shares long-term growth. Parents should assess risk tolerance; hybrids aren’t available, but diversification within stocks helps. Data from providers shows cash at 4% AER vs variable market returns.

Can anyone open a Junior ISA?

No, only parents or guardians with parental responsibility can open a JISA for a UK-resident child under 18 without a CTF. Friends or family can contribute but not open it. This rule, per GOV.UK, protects the account’s integrity. If you’re not a parent, discuss gifting options instead.

What happens to a Junior ISA at 18?

At 18, the account matures, and control transfers to the child, who can withdraw funds or roll into an adult ISA. No taxes apply on withdrawal. Parents lose management rights, so early education on finances is key. In rare cases like death, funds may access earlier, but standard is full handover.

How much can I put in a Junior ISA each year?

The maximum contribution is £9,000 for the 2025/26 tax year, split between cash and stocks if desired. Gifts count toward this limit. Exceeding it loses tax benefits; track via provider statements. This allowance rises with inflation, making it a generous option for family savings.

Can I withdraw money from a Junior ISA before age 18?

Generally, no—withdrawals before 18 close the account and forfeit tax advantages, except for terminal illness. This lock-in promotes saving discipline. Alternatives like regular accounts allow access but without tax perks. Consult HMRC for exceptions to avoid penalties.

For more options, check the best junior isa guide.