Stocks and shares ISA vs cash ISA: Which is right for you in 2025?

When comparing stocks and shares ISA vs cash ISA, the right choice depends on your financial goals, risk tolerance and time horizon. A cash ISA offers security and predictable returns through interest, ideal for short-term savings or emergencies, while a stocks and shares ISA provides potential for higher growth via investments in shares, funds or bonds, but with market volatility. In 2025, with interest rates stabilising and stock market opportunities emerging, many UK savers are weighing cash isa vs stocks and shares isa to maximise their £20,000 annual allowance tax-free.

What is a cash ISA?

A cash ISA, or individual savings account, is a tax-free savings product where your money earns interest like a regular savings account, but without UK tax on the gains. It suits those prioritising capital protection, as your deposit is covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per provider. Current top rates hover around 4-5% AER, though these can fluctuate with base rates set by the Bank of England.

What is a stocks and shares ISA?

A stocks and shares ISA allows you to invest up to £20,000 each tax year in a range of assets like individual stocks, bonds, funds or ETFs, all tax-free on capital gains and dividends. Unlike cash options, returns aren’t guaranteed and depend on market performance; historical data shows average annual returns of 5-7% over the long term, but short-term losses are possible. For beginners, what is a stocks and shares isa involves choosing a platform and diversifying to manage risk.

Core differences: Stocks and shares ISA vs cash ISA

The main distinctions between stocks and shares ISA and cash ISA lie in risk, returns and accessibility. Cash ISAs provide steady, low-risk growth through interest, protected from market dips, whereas stocks and shares ISAs offer higher potential rewards but expose you to fluctuations. Both share the same £20,000 tax-year allowance, but you can split it across types if needed.

Here’s a comparison table:

| Feature | Cash ISA | Stocks and Shares ISA |

|---|---|---|

| Risk Level | Low (FSCS protected) | Medium to High (market-dependent) |

| Potential Returns | 3-5% interest | 5-10% average long-term |

| Access | Flexible or fixed-term | Usually instant, but fees apply |

| Suitability | Short-term savings | Long-term growth (5+ years) |

| Fees | Minimal | Platform and fund charges (0.25-1%) |

Pros and cons of each option

Cash ISA pros:

- Capital security and predictable income.

- Easy to understand and access funds.

- Beats inflation better than non-ISA savings in low-rate environments.

Cash ISA cons:

- Lower returns may not outpace inflation over time.

- Rates can drop, locking in suboptimal yields on fixed terms.

- Limited growth potential compared to investing.

Stocks and shares ISA pros:

- Higher long-term growth to build wealth.

- Diversification across global markets.

- Tax-free compounding accelerates returns.

Stocks and shares ISA cons:

- Possible losses in downturns.

- Requires research or advisory fees.

- Not ideal for money needed soon.

For more on comparisons, see this detailed guide from Legal & General.

Which should you choose in 2025?

Choose a cash ISA if you’re risk-averse, saving for a near-term goal like a house deposit, or building an emergency fund for rainy days. Opt for stocks and shares vs cash ISA if you have a longer horizon, such as retirement, and can tolerate volatility for better returns. In 2025, with potential ISA reforms discussed by experts like Martin Lewis, hybrid approaches—using both types—maximise the allowance while balancing safety and growth. Community discussions on platforms like Reddit highlight real-user experiences in cash isa vs stocks and shares isa debates, emphasising personal circumstances.

Tip: Assess your risk profile first—use free online quizzes from providers. For investing starters, consider low-cost index funds in a stocks and shares ISA to mimic market performance without picking individual stocks. Always check current rates, as Moneyfacts updates weekly.

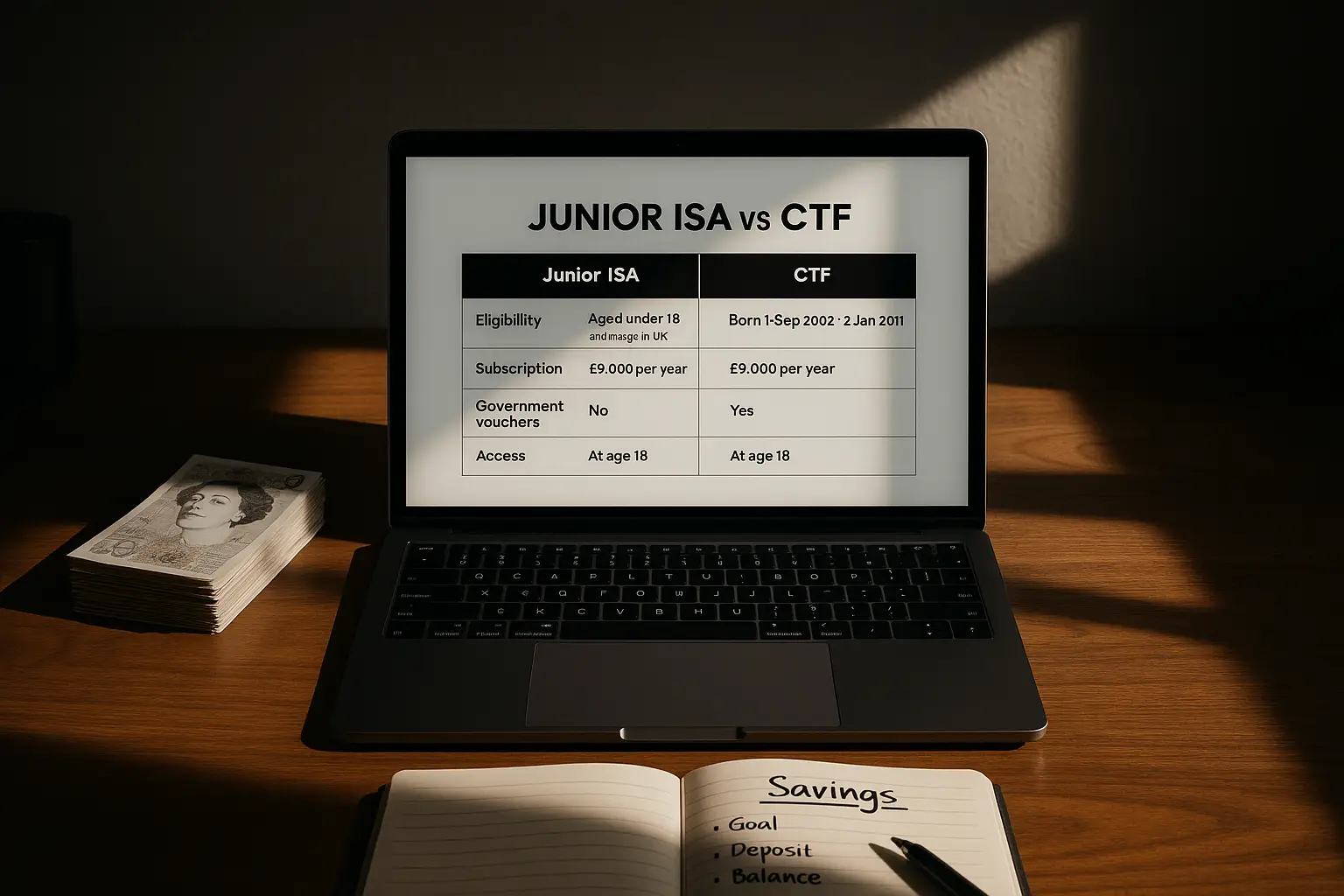

Regarding variants, a cash lifetime ISA vs stocks and shares lifetime ISA offers a 25% government bonus for first-home buyers under 40, blending savings and investment perks. For parents, junior stocks and shares ISA vs cash ISA provides tax-free growth for children’s future, with £9,000 annual limit until age 18.

To get started, learn how to open a stocks and shares isa via authorised platforms. For top picks, explore the best stocks and shares isa options reviewed by consumers.

Stay informed on rules via MoneySavingExpert’s ISA guide, which covers allowances and multiple accounts—you can have one of each type per tax year.

Frequently asked questions

What is the difference between a cash ISA and a stocks and shares ISA?

A cash ISA functions like a savings account with tax-free interest, offering low risk and steady but modest returns, protected up to £85,000 by FSCS. In contrast, a stocks and shares ISA invests in market assets for potentially higher growth, but values can fall, suiting long-term horizons. The key trade-off in stocks and shares isa vs cash isa is security versus opportunity, with both allowing up to £20,000 yearly tax-free contributions under UK rules.

Which is better: cash ISA vs stocks and shares ISA in 2025?

In 2025, cash ISA vs stocks and shares ISA depends on your needs—cash for preservation amid uncertain rates around 4%, stocks for growth if markets rebound post-inflation. Experts predict stocks could yield 6-8% annually long-term, outpacing cash, but with volatility risks. Consider your timeline: short-term favours cash, while 5+ years supports stocks; many use both for balance.

Can I have both a cash ISA and a stocks and shares ISA?

Yes, you can hold multiple ISAs, including both cash and stocks and shares types, as long as total contributions don’t exceed £20,000 per tax year from 6 April to 5 April. This allows splitting your allowance for diversified tax-free savings and investments. Rules from HMRC permit one new subscription per type annually, promoting flexible strategies like emergency cash alongside growth-focused shares.

What are the risks of a stocks and shares ISA compared to cash?

Stocks and shares ISAs carry market risk, where investments can lose value due to economic shifts, unlike cash ISAs’ principal protection. Over 10 years, stocks historically recover and outperform, but short-term dips—up to 20-30% in recessions—test patience. Mitigation involves diversification and professional advice, making it riskier yet rewarding for non-conservative savers evaluating cash vs stocks and shares isa.

How much can I put in a stocks and shares ISA vs cash ISA each year?

The ISA allowance is £20,000 total across all types for the 2024/25 tax year, unchanged for 2025 so far, covering both cash and stocks and shares ISAs. You can allocate freely, e.g., £10,000 to each, but unused allowance doesn’t carry over. This cap, set by HMRC, encourages annual reviews to optimise tax-free growth or savings.

Is a cash ISA vs stocks and shares ISA suitable for beginners?

For beginners, a cash ISA offers simplicity and safety as an entry to tax-free saving, building habits without market worries. Transitioning to stocks and shares ISA requires understanding basics like funds, but platforms simplify with ready-made portfolios. Start small, educate via resources, and blend both for a low-risk intro to investing money tax-free.

What about junior cash ISA vs junior stocks and shares ISA for children?

Junior ISAs allow £9,000 yearly for under-18s, with cash versions providing secure interest for education funds, while stocks and shares enable growth for future needs like university. Parents control until 18, when tax-free access begins; risks mirror adult versions, so conservative families prefer cash. This variant extends ISA benefits, fostering long-term family wealth planning.