Eligibility for a Lifetime ISA

A Lifetime ISA, often called a LISA, is a type of Individual Savings Account designed to help UK residents save for their first home or retirement. What is a Lifetime ISA? It combines tax-free savings growth with a government bonus to boost your funds, making it ideal for first-time buyers or long-term planners aged 18 to 39.

To qualify, you must meet specific criteria set by the UK government.

Age requirements

You can open a Lifetime ISA if you are between 18 and 39 years old. Contributions are allowed until you turn 50, giving you up to 31 years to build your savings. This age range targets younger adults starting their financial journey, as outlined on the official GOV.UK siteLifetime ISA overview from GOV.UK.

Residency rules

You need to be a UK resident to open and contribute to a Lifetime ISA. This ensures the scheme benefits those living and working in the UK, with HMRC handling the administration. Non-residents cannot participate, focusing the support on domestic savers.

First-time buyer status

For using the funds to buy a home, you must be a first-time buyer purchasing a property worth up to £450,000. No prior home ownership means you haven’t owned property anywhere in the world. This rule promotes accessibility for newcomers to the housing market.

How a Lifetime ISA Works

At its core, a Lifetime ISA lets you save up to £4,000 per tax year (running from 6 April to 5 April) with tax-free interest or growth, plus a 25% government bonus. What is a Lifetime ISA for? Primarily to assist with buying your first home or supplementing retirement savings after age 60.

Contributions and tax benefits

Contributions come from your post-tax income, but all growth inside the account is tax-free, unlike regular savings where interest might be taxed. You can pay in via bank transfer or salary, and it’s flexible for irregular deposits. This makes it a strong option compared to standard savings accounts.

Government bonus explained

The government adds a 25% bonus on your contributions, up to £1,000 annually. For every £4,000 you save, you get £1,000 free from the state, claimed automatically by the provider. As per MoneySavingExpert’s 2025 updateLifetime ISA guide from MoneySavingExpert, this bonus applies per tax year and is non-withdrawable without penalty until qualifying use.

Using funds for home or retirement

Withdraw for a first home deposit (up to £450,000) or after age 60 for any purpose, both tax-free. The funds grow over time, with Lifetime ISAs attracting £1.2 billion in 2024/25 contributions, per Hargreaves LansdownLifetime ISA record from Hargreaves Lansdown. It’s a dual-purpose tool for major life goals.

Tip: Start small if you’re new to saving— even £100 monthly qualifies for the bonus proportional to your input.

Types of Lifetime ISAs

There are two main types: cash and stocks and shares, each suiting different risk levels. What type of ISA is a Lifetime ISA? It’s a specialised ISA under the broader Individual Savings Account umbrella, with unique bonus features.

Cash Lifetime ISA

What is a cash Lifetime ISA? It’s like a savings account where your money earns interest at variable rates, currently up to 4.9% AER (Annual Equivalent Rate, the standard measure of interest). Low risk, but returns depend on market rates—safer for conservative savers.

Stocks and Shares Lifetime ISA

What is a stocks and shares Lifetime ISA? This invests in funds, shares, or bonds for potential higher growth, but with market volatility. Suitable if you’re comfortable with ups and downs, offering tax-free gains over the long term.

Key differences

Cash versions provide steady, predictable interest, while stocks and shares aim for higher returns with risk of loss. Both get the bonus, but choose based on your timeline—cash for short-term home buys, investments for retirement. Some are flexible, allowing withdrawals and re-contributions in the same year.

Contribution Limits and Bonus

The key to maximising benefits is understanding caps. What is the limit on a Lifetime ISA? It’s £4,000 yearly, part of the £20,000 overall ISA allowance for 2025/26.

Annual allowance

You can contribute up to £4,000 each tax year, with the bonus calculated on that amount. Unused allowance doesn’t roll over, so contribute early to claim the full top-up.

Maximum bonus calculation

What is the maximum bonus on a Lifetime ISA? It’s 25% of your contribution, capped at £1,000. For example, £3,200 saved gets £800 bonus; full £4,000 yields £1,000.

| Year | Contribution | Government Bonus | Total (no interest) |

|---|---|---|---|

| Year 1 | £4,000 | £1,000 | £5,000 |

| Year 2 | £4,000 | £1,000 | £10,000 |

| Year 3 | £4,000 | £1,000 | £15,000 |

| Year 4 | £4,000 | £1,000 | £20,000 |

| Year 5 | £4,000 | £1,000 | £25,000 |

Note: Assumes maximum contributions; actual growth varies.

Integration with overall ISA limit

Your Lifetime ISA counts towards the £20,000 total ISA allowance, shared with cash ISAs or stocks and shares ISAs. Plan accordingly to avoid exceeding limits, as per Hargreaves Lansdown’s 2025 rulesISA allowance details from Hargreaves Lansdown.

Interest Rates and Growth Potential

Growth depends on the type you choose. What is the interest rate on a Lifetime ISA? For cash, it’s variable, often competitive with high-street savings.

Current rates for cash LISAs

As of October 2025, top cash Lifetime ISAs offer up to 4.9% AER, beating many standard accounts. Rates fluctuate, so check providers regularly. This makes them attractive for steady growth towards a deposit.

Investment risks in stocks and shares

Stocks and shares LISAs can grow faster but may lose value short-term. Diversify to manage risk, and remember it’s tax-free. Not for those needing quick access.

Tax-free growth

All interest, dividends, or capital gains are tax-free, enhancing long-term potential. Over decades, compounding can significantly boost your nest egg.

Withdrawals and Penalties

Accessing funds has rules to encourage long-term saving. What is a Lifetime ISA withdrawal? Qualifying uses avoid charges; others face penalties.

Qualifying vs non-qualifying withdrawals

Qualifying: First home (under £450,000) or post-60 for any purpose. Non-qualifying: Anything else before 60, like emergencies.

Penalty details

What is a Lifetime ISA withdrawal penalty? A 25% charge applies to non-qualifying withdrawals, effectively reclaiming the bonus and your growth. For example, withdrawing £5,000 (including £1,000 bonus) costs £1,250, leaving £3,750. This deters early access but protects your savings habit.

Exceptions and flexibility

Terminal illness under 60 allows penalty-free withdrawal. Flexible ISAs let you replace withdrawn funds without affecting allowance. Always confirm with your provider.

- Check eligibility before withdrawing to avoid surprises.

- Consider alternatives like emergency funds outside the LISA.

- Transfers to another provider are penalty-free.

Popular Providers and How to Open

Several UK banks and apps offer Lifetime ISAs. What is a Lifetime ISA Moneybox? It’s a popular app-based option with easy setup, endorsed by experts like Martin Lewis. For the best lifetime isa options, compare rates and fees.

Top UK providers

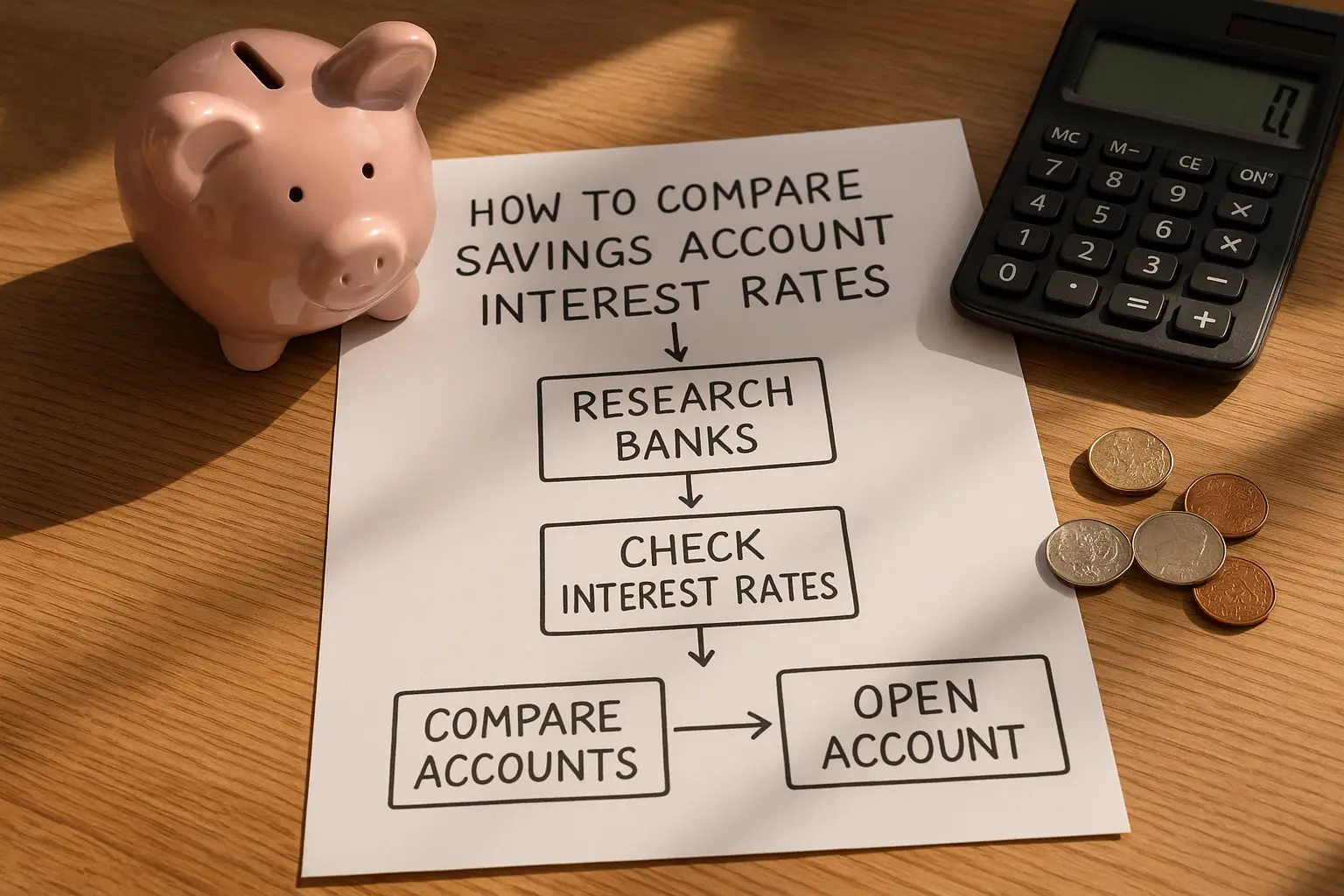

Providers include Moneybox, HSBC, Nationwide, and Hargreaves Lansdown. Each offers cash or investment versions; Moneybox suits beginners with its app, while HSBC provides branch support. Rates and features vary, so review independently.

Steps to open an account

1. Confirm eligibility on GOV.UK.

2. Choose cash or stocks and shares.

3. Select a FCA-regulated provider and apply online (takes 10-15 minutes).

4. Fund via transfer and claim bonus automatically.

What is a Lifetime ISA account? It’s opened digitally with ID verification.

Transferring existing ISAs

You can transfer from Help to Buy or other ISAs without penalty, preserving bonuses. Contact your new provider to initiate—process takes weeks. This keeps your savings intact.

Lifetime ISA vs Other Savings Options

Weighing options helps decide fit. A Lifetime ISA stands out for its bonus but has restrictions.

Comparison to Help to Buy ISA

Help to Buy ISAs offer a 25% bonus but are closed to new savers since 2019, with lower £200/month limits. Lifetime ISAs are open, allow £4,000/year, and support retirement too. Transfer if eligible, but check GOV.UK for differences.

Vs regular ISAs

Regular ISAs have higher £20,000 limits but no bonus. Lifetime ISAs cap at £4,000 but add government help for specific goals. Use both if within allowance.

Pros and cons for beginners

Pros: Bonus boosts savings, tax-free, goal-oriented. Cons: Penalty risk, age limits. Ideal if committed to home or retirement; otherwise, standard savings may suit better.

Frequently asked questions

Who is eligible for a Lifetime ISA?

Eligibility for a Lifetime ISA requires you to be 18-39 and a UK resident. You don’t need to be a first-time buyer to open it, but that status matters for home withdrawals. This setup, per GOV.UK, targets young adults building wealth, with contributions possible until 50 for extended growth.

How much can I put into a Lifetime ISA?

The annual limit is £4,000, part of the £20,000 total ISA allowance. You can contribute less, but the bonus is 25% up to £1,000 maximum. For 2025/26, this remains unchanged, allowing flexible saving based on your budget while maximising government support.

What is the government bonus on a Lifetime ISA?

The bonus is 25% of your contributions, capped at £1,000 per tax year. It’s added automatically after your provider claims it from HMRC, typically within 30 days. This incentive, highlighted by MoneySavingExpert, can add thousands over time but only for eligible uses to avoid penalties.

What happens if I withdraw money early?

Early non-qualifying withdrawals incur a 25% charge, which recoups the bonus and may dip into your original savings. For instance, on £5,000 total, you’d lose £1,250, netting £3,750. Exceptions apply for terminal illness; otherwise, plan alternatives like separate emergency pots to sidestep this.

Can I transfer my Lifetime ISA?

Yes, transfers to another provider are allowed without penalty, keeping your bonus intact. The process takes 4-8 weeks and must be direct to avoid tax issues. This flexibility helps switch for better rates, but confirm all funds move correctly with HMRC oversight.

What’s the difference between a Lifetime ISA and a Help to Buy ISA?

Lifetime ISAs offer broader use (home or retirement) with higher £4,000 limits, while Help to Buy was home-only with £2,400 yearly max and now closed. Both give 25% bonuses, but Lifetime ISAs can accept transfers from Help to Buy. For first-time buyers in 2025, Lifetime ISAs provide ongoing access per official rules.

What is a flexible Lifetime ISA?

A flexible Lifetime ISA lets you withdraw and replace funds in the same tax year without using extra allowance. Not all providers offer this, but it’s useful for temporary needs like rent. Check terms to ensure it fits your saving strategy without losing bonus eligibility.