Understanding savings account interest rates in 2025

Savings account interest rates in the UK for 2025 offer opportunities to grow your money, with top easy access rates reaching 4.75% AER, as reported by MoneySavingExpert. This means that for every £1,000 saved, you could earn up to £47.50 in interest annually, assuming the rate stays stable. However, the average easy access rate sits at 3.2%, according to Which?, highlighting the importance of a thorough savings account interest rates comparison to find the best returns.

What is AER versus gross interest?

AER, or Annual Equivalent Rate, represents the true yearly return on your savings, accounting for compounding interest where earnings are added to the principal multiple times a year. Gross interest, on the other hand, is the rate before tax deductions, often quoted without considering how frequently interest is paid. For a fair comparison of savings account interest rates, always focus on AER, as it provides a standardised view— for example, a 4% gross rate paid monthly equates to about 4.07% AER.

How does the Bank of England base rate impact savings rates?

The Bank of England base rate directly influences savings account interest rates, as banks adjust their offerings to remain competitive. In 2025, with the base rate holding steady, fixed-rate options like bonds are offering up to 4.55% for one-year terms, per Moneyfactscompare. If the base rate rises, expect variable rates on easy access accounts to follow suit, making it essential to monitor changes for your savings account interest rates comparison.

Tax rules and allowances for savers

Under the Personal Savings Allowance, basic rate taxpayers can earn £1,000 in tax-free interest annually, while higher rate taxpayers get £500, as outlined by GOV.UK for the 2025-26 tax year. Interest beyond this is taxed at your income tax rate, so a high interest savings account UK could push you over the limit if you’re a higher earner. For tax-free growth, consider Cash ISAs, which allow up to £20,000 annual contributions without affecting your allowance.

Top easy access savings rates comparison

Easy access savings accounts provide flexibility, with the highest rates in 2025 hitting 4.75% AER from providers like those highlighted on MoneySuperMarket. These accounts let you withdraw funds anytime without penalty, ideal for emergency savings, though rates can fluctuate. A comparison of savings account interest rates shows online banks often outperform high street ones, offering better yields for minimal effort.

Best rates from major banks

Major banks like NatWest and Nationwide lead with competitive easy access rates around 3-4% AER, but they lag behind specialists. For instance, NatWest’s Digital Saver offers 3.5% AER with no minimum deposit, while Nationwide’s Flex Instant Saver provides 3.75% AER. In a savings account interest rates comparison, these are solid for convenience but check for introductory bonuses that may drop after 12 months.

Online versus high street providers

Online savings account interest rates comparison reveals digital providers like Chip at 4.6% AER, surpassing high street averages of 3.2%. High street banks offer branches for in-person support but lower rates due to overheads, whereas online options like those from Money.co.uk’s picks provide higher yields with app-based management. If you value accessibility, online high interest savings accounts UK deliver up to 4.80% AER without branches.

Minimum balance requirements

Many top accounts require just £1 minimum deposit, such as those from online challengers, making them accessible for beginners. However, some like premium accounts from building societies demand £10,000+ to unlock the best rates. When conducting a comparison of savings account interest rates, factor in these thresholds to avoid low introductory rates on smaller balances.

Tip: Use a savings calculator to project earnings— for £10,000 at 4.75% AER, you’d gain £475 yearly, beating inflation if rates hold.

| Provider | Rate (AER) | Type | Min Deposit | Access |

|---|---|---|---|---|

| Chip | 4.60% | Easy Access | £1 | Instant |

| NatWest | 3.50% | Digital Saver | £1 | Instant |

| Nationwide | 3.75% | Flex Instant | £1 | Instant |

| Yorkshire Building Society | 4.20% | Online Saver | £10 | Instant |

| MoneySuperMarket Pick | 4.80% | High Yield | £1 | Instant |

For more on best savings rates, explore our pillar guide. Discover high yield savings accounts for maximum returns.

Fixed rate bonds and ISAs breakdown

Fixed rate bonds lock your money for a set period, offering stability with rates up to 4.55% AER for one year in 2025, according to Moneyfactscompare. Cash ISAs provide similar security tax-free, with top rates mirroring non-ISA bonds. In an interest rates savings account comparison, fixed options suit those not needing immediate access, potentially outpacing variable rates if the base rate falls.

One-year versus longer terms

One-year fixed bonds yield around 4.5%, per MoneyWeek, ideal for short-term goals, while two-year terms might offer 4.2% with less risk of rate drops. Longer terms like five years provide security but lower initial rates, around 3.8%. Compare based on your timeline— a comparison savings account interest rates shows shorter terms winning in the current stable environment.

Cash ISA options

Cash ISAs from providers like Nationwide offer up to 4.5% AER tax-free, protecting your £20,000 allowance from tax. Easy access ISAs balance flexibility with yields around 4%, while fixed ISAs guarantee rates. For UK savers, these beat taxable accounts if nearing your Personal Savings Allowance.

Lock-in periods and penalties

Fixed bonds typically lock funds for 6-60 months, with early withdrawal penalties of 90-180 days’ interest. ISAs follow similar rules but offer tax perks. Always review terms in your high interest savings account rates comparison to avoid surprises.

How to choose the right savings account

Prioritise AER, access needs, and FSCS protection (up to £85,000 per provider) when selecting— top picks from Which? ensure safety. Beyond rates, consider fees and customer service. Use tools for a personalised savings account comparison interest rates to match your goals.

Factors beyond rates

Evaluate withdrawal limits, app usability, and bonuses— for example, regular saver accounts from NatWest offer boosted rates for monthly deposits. Inflation at 2% means rates above this preserve value. Link to our guide on how to find high interest savings accounts for strategies.

Safety and FSCS coverage

All UK-regulated accounts are protected by FSCS up to £85,000, covering banks like Nationwide. Spread savings across providers if over this limit. This security underpins any best savings account interest rates comparison.

Using calculators for projections

Online calculators from sites like MoneySuperMarket project growth— £5,000 at 4.75% AER yields £237.50 after tax considerations. Factor in your tax band for accurate forecasts.

For current savings rates, see our latest options.

2025 rate forecasts and tips

Rates may dip to 4% by late 2025 if the base rate cuts, as forecasted by MoneyWeek, but high-yield options could hold strong. Adjust for 2% inflation to maintain purchasing power. Switch accounts easily via the Current Account Switch Service for better deals.

Expected changes in rates

With stable base rates, easy access could average 4%, but fixed bonds might lock in higher now. Monitor Bank of England announcements for shifts in UK savings account interest rates comparison.

Inflation adjustments

Aim for rates exceeding inflation— 4.75% beats 2%, netting real growth. Use our best online savings accounts for competitive edges.

Switching strategies

Review annually; transfer to higher-rate accounts without fees. Start with a comparison of best savings account interest rates to maximise earnings.

Pro tip: Diversify between easy access and fixed for liquidity and guaranteed returns— protect up to £170,000 across two FSCS-covered providers.

Frequently asked questions

What is the best savings account interest rate in the UK?

The highest easy access rate in the UK for 2025 is 4.75% AER from select providers, as per MoneySavingExpert, ideal for flexible savings. Fixed options reach 4.55% for one year via Moneyfactscompare, suiting those planning ahead. Always verify current offers, as rates change, and ensure FSCS protection for safety in your choice.

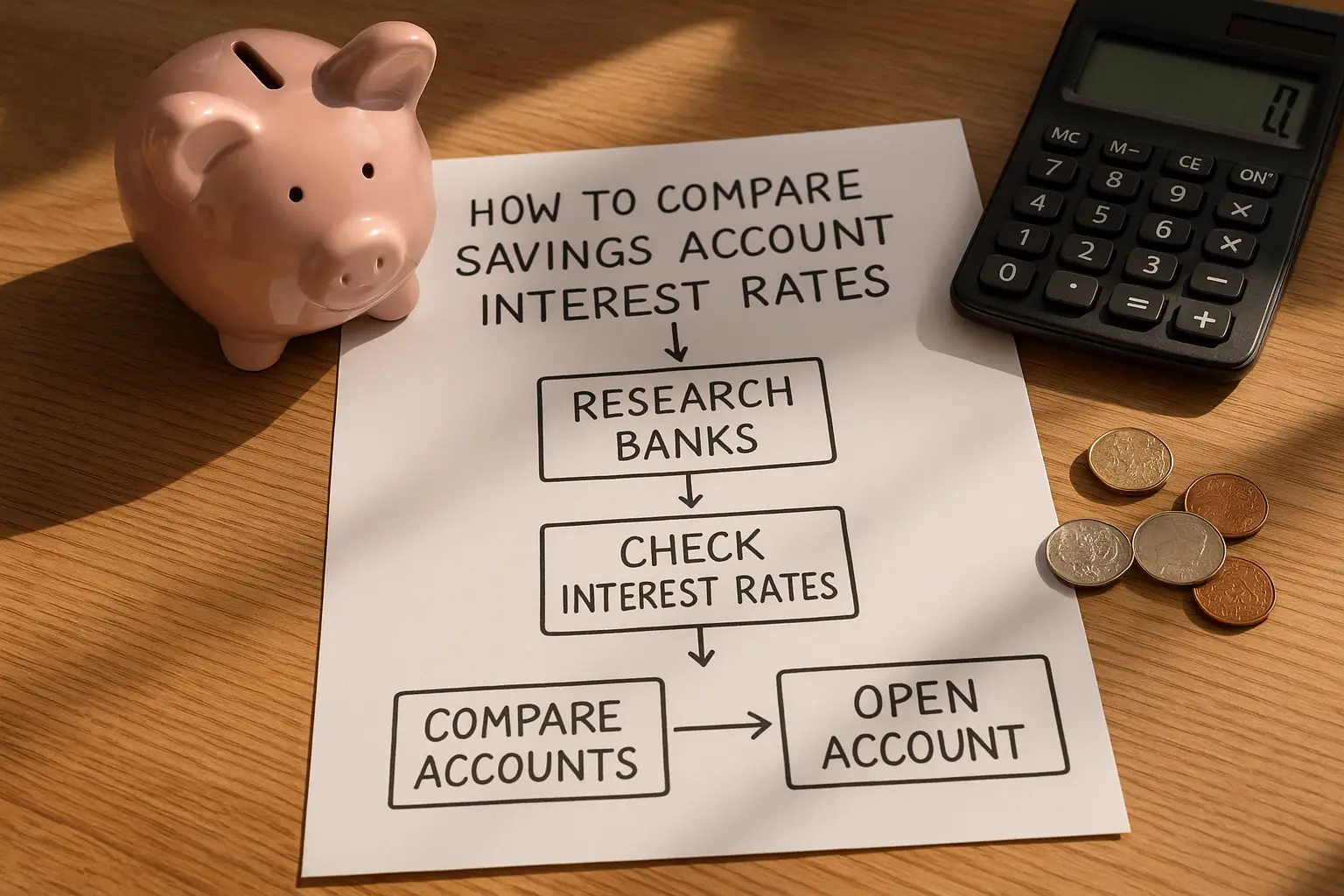

How do I compare savings accounts effectively?

Start with AER for apples-to-apples comparisons, then check access types and minimums using tools like those on Which?. Factor in tax implications via GOV.UK’s Personal Savings Allowance details. For depth, review provider ratings and use side-by-side tables to spot the best match for your needs, saving time and boosting returns.

Are savings rates expected to rise in 2025?

Forecasts from MoneyWeek suggest rates may stabilise or slightly decline to around 4% amid potential base rate cuts, but high-yield accounts could buck the trend up to 4.80%. Economic factors like inflation will influence this; monitor Bank of England updates. If rates rise, easy access accounts benefit most, rewarding proactive switchers.

What’s the difference between AER and gross interest?

AER calculates the effective annual rate including compounding, giving a realistic yearly return, while gross is the pre-tax rate without compounding effects. For example, 4% gross monthly compounds to 4.07% AER. Use AER in comparisons for accuracy, especially in variable-rate environments like 2025’s UK market.

Which banks have the highest savings rates?

Online-focused banks like Chip offer 4.6% AER, outpacing high street giants like NatWest at 3.5%, according to Money.co.uk. Building societies such as Yorkshire provide 4.2%, blending rates with service. For the top spots, prioritise challengers in your bank savings account interest rates comparison, ensuring UK regulation.

How does tax affect my savings interest in 2025?

Basic rate taxpayers enjoy £1,000 tax-free under PSA, per GOV.UK, but excess is taxed at 20%. Higher earners get £500, making ISAs crucial for larger sums. Calculate your exposure— for £20,000 at 4% yielding £800, it fits within basic allowance, but monitor to avoid surprises.

What are the risks of high interest savings accounts?

Variable rates can drop unexpectedly, eroding returns below inflation, as seen in past base rate cuts. Liquidity limits on some high-yield options may incur penalties. Mitigate by diversifying and reviewing quarterly, using FSCS for capital protection up to £85,000.