Understanding mortgage deals in the UK

Finding the best mortgage deals in the UK requires understanding the options available and how market conditions influence them. In 2025, with the Bank of England base rate holding steady at 5%, borrowers can expect competitive rates, particularly for fixed-term products. This guide compares top mortgage deals, focusing on fixed rates, first-time buyer offers, and buy-to-let options to help you navigate the landscape.

Types of mortgage deals

Mortgage deals fall into several categories, each suited to different needs. Fixed rate mortgages lock in your interest for a set period, such as two or five years, providing payment stability. Tracker mortgages follow the base rate plus a margin, offering flexibility but potential volatility. Interest-only deals allow payments on interest alone, often for investors, while repayment mortgages cover both principal and interest. For those seeking the best fixed rate mortgage deals, fixed options remain popular due to their predictability in 2025.

Factors affecting 2025 rates

Several elements shape mortgage rates in 2025. The Bank of England base rate, currently at 5%, directly impacts tracker and variable deals, with trackers starting from 5.25%. Inflation trends and lender competition have driven cuts in fixed rates, with averages for two-year fixes between 4.0% and 4.5% as of October 2025, according to HomeOwners Alliance (2025). Loan-to-value (LTV) ratio—the percentage of the property value you borrow—also plays a key role; lower LTVs (higher deposits) unlock better rates. Economic forecasts suggest further base rate reductions could lower overall mortgage costs later in the year.

How to qualify for the best offers

To access the best UK mortgage deals, lenders assess your credit score, income stability, and deposit size. A strong credit history and LTV below 60% often qualify you for sub-4% rates. First-time buyers may benefit from schemes like shared ownership, while remortgagers should check for early repayment charges. Always compare annual percentage rate (APR), which includes fees, against headline interest rates for a true cost picture.

Quick tips for improving eligibility

- Check your credit report via services like Experian and correct errors.

- Save for a larger deposit to reduce LTV and access premium deals.

- Gather proof of income, such as payslips or tax returns, early.

Best fixed rate mortgage deals

Fixed rate mortgages dominate the best mortgage deals in 2025, offering security amid uncertain economic signals. Average five-year fixed rates have dropped to 4.36% from 4.75% earlier in the year, per Which? (2025). These deals suit those planning long-term homeownership, with options for various LTVs.

Top two-year fixed rates

For shorter commitments, two-year fixed deals start at around 4.0%, ideal for those expecting rate falls. Lenders like Nationwide and HSBC offer competitive products with fees under £1,000 for 75% LTV. These provide a balance of low initial costs and flexibility at the end of the term.

Best five-year fixed options

Five-year fixes appeal to stability seekers, with top rates at 4.2% for 60% LTV. Barclays and NatWest lead with no-fee variants, making them among the best mortgage fixed rate deals for home movers. Consider early repayment charges, typically 5% in year one, dropping annually.

| Lender | Rate | LTV | Fees | Type |

|---|---|---|---|---|

| Nationwide | 4.05% | 75% | £999 | 2-year fixed |

| HSBC | 4.39% | 95% | £0 | 2-year fixed |

| Barclays | 4.20% | 60% | £999 | 5-year fixed |

| NatWest | 4.36% | 80% | £0 | 5-year fixed |

Data sourced from MoneySuperMarket (2025); rates subject to change.

Mortgage deals for first time buyers

First-time buyers face unique challenges, but 2025 brings accessible best mortgage deals for first time buyers, with 95% LTV options from 4.39%. Government-backed schemes enhance affordability for those with smaller deposits.

Government schemes and incentives

The Lifetime ISA offers a 25% bonus on savings up to £1,000 monthly, aiding deposits. Shared ownership allows buying a stake in a property, with mortgages on the share only. These support the best first time buyer mortgage deals, especially amid rising house prices.

Low deposit deals

Deals at 90-95% LTV start at 4.5%, though fees may apply. Lenders like Accord and Skipton provide no-fee products for deposits as low as 5%, per Compare the Market (2025). Prioritise affordability checks to avoid overborrowing.

Affordability tips

Use online calculators to estimate payments based on income multiples (typically 4.5x salary). Factor in ongoing costs like insurance. Consulting a broker can uncover tailored best mortgage deals first time buyers.

Buy to let and remortgage deals

Investors and existing homeowners have specialised options among the best buy to let mortgage deals and remortgage products in 2025.

Top BTL rates

Buy-to-let mortgages average 5.2% for two-year fixes, with best deals under 4.8% for 75% LTV and higher yields. Specialist lenders like Paragon offer interest-only variants, but stress tests require proving rental income covers 125-145% of payments. See Money To The Masses (2025) for updates.

Remortgaging strategies

Switching deals can save thousands; average remortgage rates mirror residential fixes at 4.3%. Time applications six months before your deal ends to avoid standard variable rates (SVRs) up to 7%. Look for best mortgage deals for remortgaging with cashback incentives.

Interest-only vs repayment

Interest-only suits BTL, reducing monthly outgoings but requiring a repayment plan. Repayment builds equity, better for personal homes. Weigh risks like negative equity in volatile markets.

Current trends and 2025 forecasts

Mortgage rates are falling in 2025, driven by lender competition and potential base rate cuts. Current best mortgage deals today hover at 4.0% for primes, with trackers slightly higher.

Rate predictions

Experts forecast two-year fixes dipping below 4% by mid-2025 if inflation eases, per Bank of England data. However, geopolitical factors could stabilise or reverse trends.

Market influences

Housing demand, stamp duty changes, and regulatory shifts from the FCA impact availability. Monitor best mortgage deals 2025 for updates.

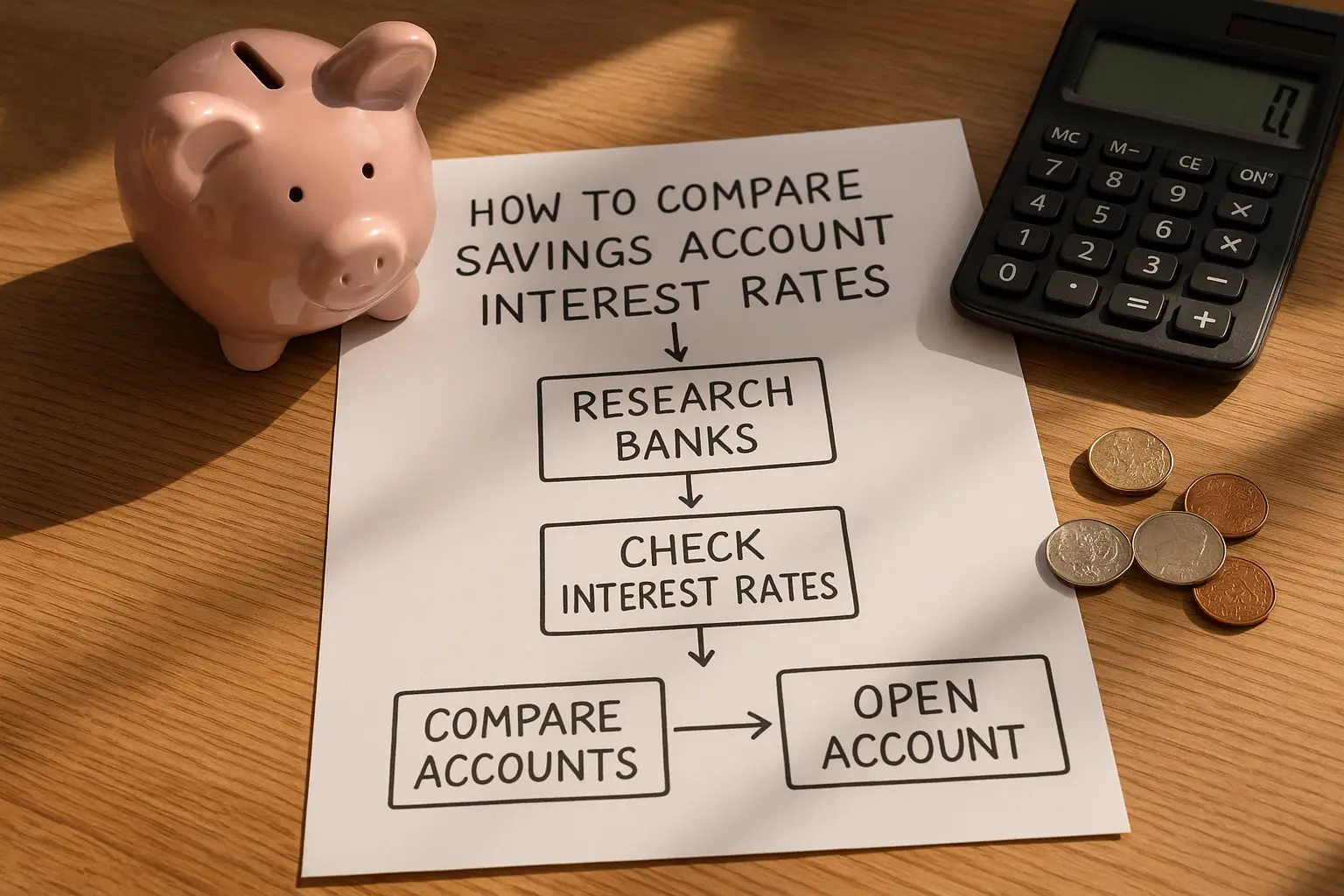

How to compare deals

Use comparison sites filtering by LTV, fees, and term. Calculate total cost over the deal period, not just initial rate. Independent advice ensures you select from the best UK mortgage deals.

Next steps for securing a mortgage

This information empowers informed decisions, but remember, this is not personalised financial advice—consult professionals for your situation.

Using calculators

Online tools from sites like MoneySuperMarket simulate payments. Input salary, deposit, and term for affordability insights.

Broker advice

Whole-of-market brokers access exclusive best current mortgage deals, saving time and potentially money.

Application process

Gather documents, get an agreement in principle, then full application. Expect valuations and legal checks; aim for pre-approval to strengthen offers.

Frequently asked questions

What are the current best mortgage rates in the UK?

As of late October 2025, the best mortgage rates in the UK for two-year fixed deals range from 4.0% to 4.5% for borrowers with solid credit and lower LTVs. Five-year options average 4.36%, providing longer stability. These rates reflect recent lender cuts amid stable base rates, but they vary by lender and personal circumstances—always verify with current comparisons for the best mortgage deals UK.

How do I compare mortgage deals?

To compare mortgage deals, start by assessing your LTV, credit score, and borrowing needs using online tools or broker services. Focus on APR to include fees, and consider incentives like free valuations. Sites such as Which? offer daily updates, helping identify the best UK mortgage deals tailored to first-time buyers or remortgagers, ensuring you avoid pitfalls like high early repayment charges.

What is the best fixed rate mortgage for first time buyers?

The best fixed rate mortgage for first time buyers in 2025 includes 95% LTV deals from 4.39%, often with government scheme support like Help to Buy extensions. Lenders prioritise affordability assessments, so stable income is key. These options, such as those from HSBC, provide secure payments early in homeownership, but compare fees to maximise value in best mortgage deals for first time buyers.

Are mortgage rates falling in 2025?

Yes, mortgage rates are falling in 2025, with fixed averages dropping due to competition and anticipated base rate easing from the Bank of England. From 4.75% earlier, five-year fixes now stand at 4.36%, benefiting home movers and investors. However, rises could occur if inflation persists; track trends via official sources for informed best mortgage deals 2025 planning.

What LTV ratios qualify for the best deals?

The best deals typically require LTV ratios of 60% or lower, demanding a 40% deposit, unlocking sub-4% rates. For 75-80% LTV, rates hover at 4.2-4.5%, while 90-95% suits first-timers but adds 0.5-1% premiums. Lower LTV reduces lender risk, improving access to top products—calculate yours (loan divided by property value) to target the best mortgage deals in the UK.

How can I find the best buy to let mortgage deals?

Finding the best buy to let mortgage deals involves checking specialist lenders for rates around 4.8-5.2%, ensuring rental coverage meets stress tests. Use comparison platforms filtering for BTL, and consider interest-only for cash flow. Tax changes like higher stamp duty apply, so consult advisors for strategies aligning with your portfolio in the evolving 2025 market.