Understanding mortgage deal calculators

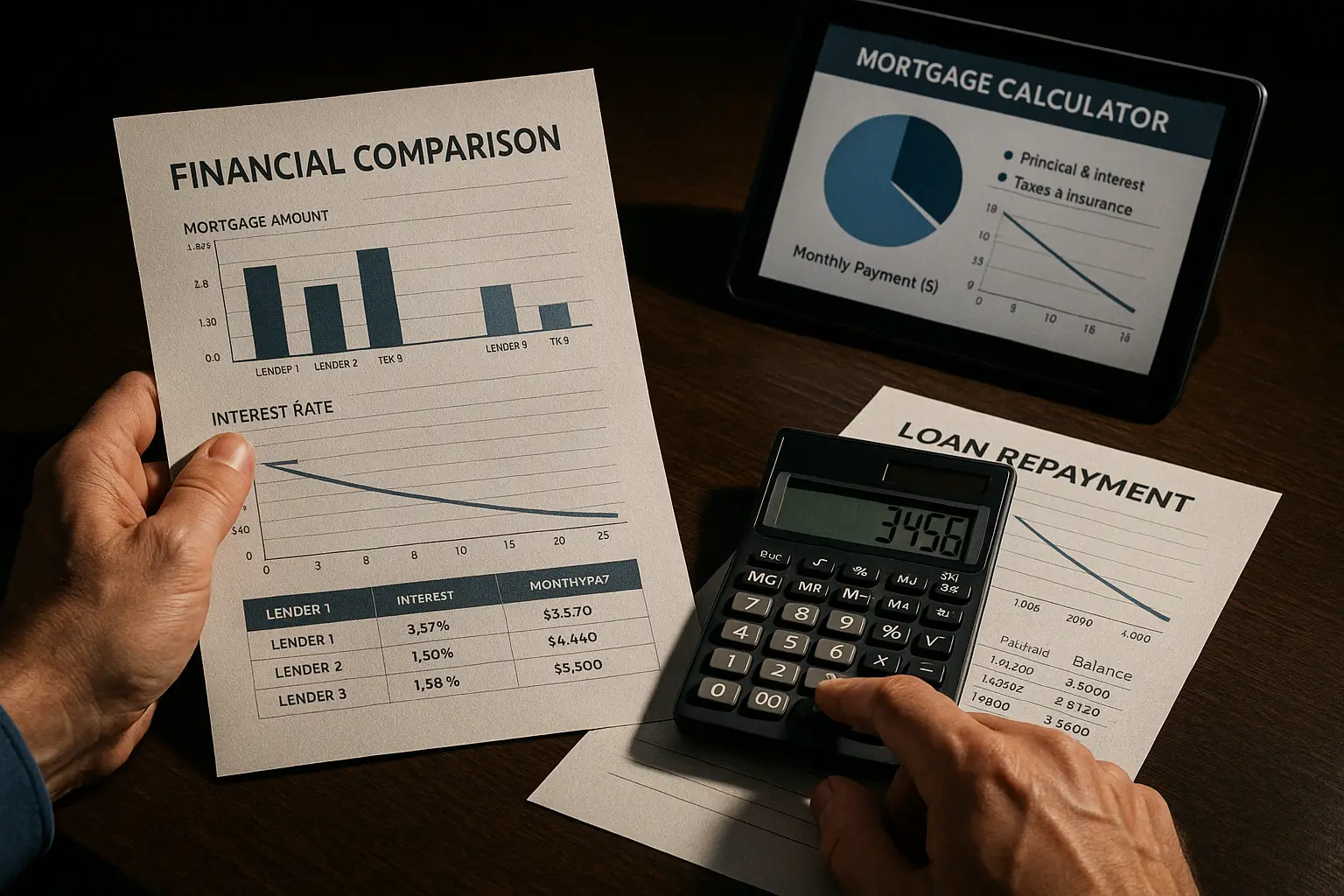

A mortgage deal calculator helps you estimate monthly payments and potential savings by inputting key details like loan amount, interest rate, and term length, giving you a clear picture of affordability before committing to a deal. These tools are essential for UK homebuyers and remortgagers navigating variable market conditions.

Mortgage deal calculators work by applying standard formulas to your inputs, such as the principal (loan amount), annual percentage rate with costs (APRC), and repayment period, to compute total interest and monthly outgoings. For instance, they factor in whether you’re opting for a repayment mortgage—where you pay off both capital and interest—or interest-only options. This allows quick comparisons of different mortgage deals UK-wide, highlighting how a lower rate can reduce long-term costs.

Key inputs include the property value or loan size, deposit amount (which affects loan-to-value or LTV ratio—the percentage of the home’s value you’re borrowing), interest rate from current lenders, and term (typically 25-30 years). UK-specific elements like stamp duty or early repayment charges can also be included in advanced mortgage calculator uk versions. Benefits extend to savings estimation: by tweaking rates from best mortgage rates uk sources, you might spot deals saving thousands over the loan life, empowering informed decisions without formal advice.

Tip: Always cross-check calculator outputs with a professional mortgage advisor, as they provide estimates only and do not account for personal circumstances like credit history.

Best UK mortgage calculators for 2025

For 2025, top mortgage calculators in the UK blend simplicity with depth, focusing on repayment calculations and deal comparisons to suit first-time buyers and those remortgaging. Repayment tools like the MoneySavingExpert mortgage repayment calculator excel at projecting monthly payments and total interest, using up-to-date UK rates.

Comparison calculators, such as those from MoneyHelper, allow side-by-side analysis of fixed versus variable rates, incorporating mortgage comparison features to evaluate deals. Affordability estimators answer queries like how much can i borrow mortgage by factoring in income, outgoings, and LTV limits under UK lending rules (usually up to 4.5 times salary). For remortgage calculator needs, options from Nationwide help simulate switching costs and savings.

Explore reliable tools at the MoneyHelper mortgage calculator or the MoneySavingExpert mortgage rate calculator, both updated for 2025 trends.

Current UK mortgage rates and deal impacts

In late 2025, cheapest 5-year fixed mortgage rates at 70% LTV hover around 4.5-5%, down from earlier peaks, influencing payment estimates via your mortgage deal calculator (source: UK Property Insight on X, accessed 6 November 2025). Variable rates track the Bank of England base rate, currently stable but sensitive to economic shifts.

Higher rates significantly impact payments: on a £213,750 mortgage over 25 years, a 2% rate yields £906 monthly, while 5.5% rises 45% to £1,313 (source: DarrenTheDegen on X, 2023 data). For a £350,000 loan at 5.5% over 25 years, total payments reach £644,745 versus £445,126 at 2% (source: Merryn Somerset Webb on X, 2023). Switching deals can save substantially; use a mortgage payment calculator to model this.

Average UK house prices stood at £285,000 in 2023, with first-time buyers averaging 25% deposits (£71,250), amplifying affordability checks (source: DarrenTheDegen on X). Check Bank of England base rate announcements for latest updates. For deeper insights, see our guide on current mortgage rates.

| Interest Rate | Term (Years) | Monthly Payment | Total Repaid |

|---|---|---|---|

| 2% | 25 | £849 | £254,700 |

| 4% | 25 | £1,055 | £316,500 |

| 5.5% | 25 | £1,180 | £354,000 |

| 4% | 30 | £955 | £343,800 |

| 5.5% | 30 | £1,139 | £410,000 |

Step-by-step guide to using a calculator

Start by gathering your details: property price (e.g., £285,000 average), deposit, income for affordability, and desired term. Input these into a mortgage deal comparison calculator to generate baseline payments.

Outputs show monthly repayments, total interest, and potential savings from rate changes—interpret by comparing against your budget, noting APRC for full costs. Common pitfalls include ignoring fees or overestimating borrowing; UK rules cap loans at 95% LTV for most. For deal hunting, try Nationwide mortgage calculators.

To compare options effectively, visit our page on compare mortgage deals.

Factors influencing mortgage deals

LTV ratio and credit score are pivotal: lower LTV (e.g., 60% with 40% deposit) unlocks better rates, while strong credit improves eligibility. Buy-to-let mortgages differ from residential, often requiring higher deposits and rental coverage proofs.

Overpayments or offsets can shave years off terms, boosting savings—model these in your repayment calculator. Discover more on securing optimal terms in our article on how to get the best mortgage deal. Note: this is general information, not personalised financial advice; consult a broker.

For the latest opportunities, review best mortgage deals on our pillar page.

Frequently asked questions

How does a mortgage calculator work?

A mortgage calculator uses a formula based on the loan principal, interest rate, and term to estimate repayments, often employing the annuity method for accuracy in UK contexts. It breaks down principal and interest portions, helping users see how extra payments reduce totals. For best results, input realistic UK mortgage rates uk data to avoid skewed projections, and remember it excludes fees like arrangement costs.

What is the best mortgage calculator UK?

The best mortgage calculator UK depends on needs, but impartial options like MoneyHelper’s tool stand out for affordability and repayment estimates without bias. For advanced features, MoneySavingExpert’s version includes overpayment scenarios, ideal for 2025 deal hunting. Always verify with multiple sources for comprehensive mortgage comparison, ensuring alignment with your LTV and borrowing capacity.

How to calculate mortgage payments?

To calculate mortgage payments, divide the annual interest rate by 12 for monthly rate, then apply it to the loan balance over the term using an amortisation schedule. Online mortgage payment calculators simplify this, factoring in fixed or variable rates for precise UK estimates. Beginners should start with basic inputs, while experts can adjust for offsets to optimise long-term savings.

What mortgage can I afford?

Typically, lenders offer up to 4.5 times your annual income, but affordability hinges on outgoings, deposit, and stress tests at higher rates. Use an affordability calculator to simulate scenarios, considering average deposits of £71,250 for first-time buyers on £285,000 homes (2023 data). Risks include overborrowing; experts advise buffering for rate rises, ensuring payments stay below 30% of income.

Current UK mortgage rates?

As of late 2025, fixed rates average 4.5-5% for 5-year deals at low LTV, with variables around the base rate plus margins. These impact total costs dramatically—a 3.5% jump on £350,000 could add nearly £200,000 over 25 years (2023 illustration). Monitor trends via official sources; compare using tools to find savings from better deals.

Can a mortgage deal calculator help with remortgaging?

Yes, a remortgage calculator estimates new payments and exit fees from your current deal, highlighting equity release potential. Input existing balance and fresh rates to quantify savings, crucial amid 2025 stabilising markets. Advanced users can model early repayment charges, but consult advisors for tax implications on residential versus buy-to-let switches.