Quick tip: Always check your credit report for free from agencies like Equifax or Experian before applying for a mortgage. Errors can lower your score and affect the rates you qualify for.

Assess your financial situation

Start by evaluating your finances to understand what you can realistically borrow. This step ensures you avoid overextending and positions you to secure better mortgage rates. Begin with your credit score, as lenders use it to determine eligibility and interest rates.

Check your credit score

Your credit score reflects your borrowing history and directly impacts how to get the best mortgage deal. A strong score above 800 can secure rates 0.5-1% lower than average, saving up to £200 monthly on a £200,000 loan over 25 years, according to MoneySavingExpert (2025). Get free reports from Equifax, Experian, or TransUnion, and dispute any inaccuracies. Improving your score by paying off debts or registering on the electoral roll can boost your application within months.

Use mortgage calculators

Mortgage calculators help estimate what mortgage you can afford based on income, outgoings, and deposit size. Tools like the mortgage calculator UK from reputable sites provide a mortgage quote for monthly payments. For example, input your salary and expenses to see if a £250,000 loan at current mortgage rates is viable. This affordability check, mandated by the Financial Conduct Authority, prevents rejections later.

Determine borrowing capacity

Lenders typically offer 4-5 times your annual income, minus debts. Factor in the loan-to-value (LTV) ratio, which is the loan amount divided by property value. A 10% deposit means 90% LTV, often qualifying for lower rates. Use a mortgage payment calculator to project costs, including interest rates UK trends from the Bank of England.

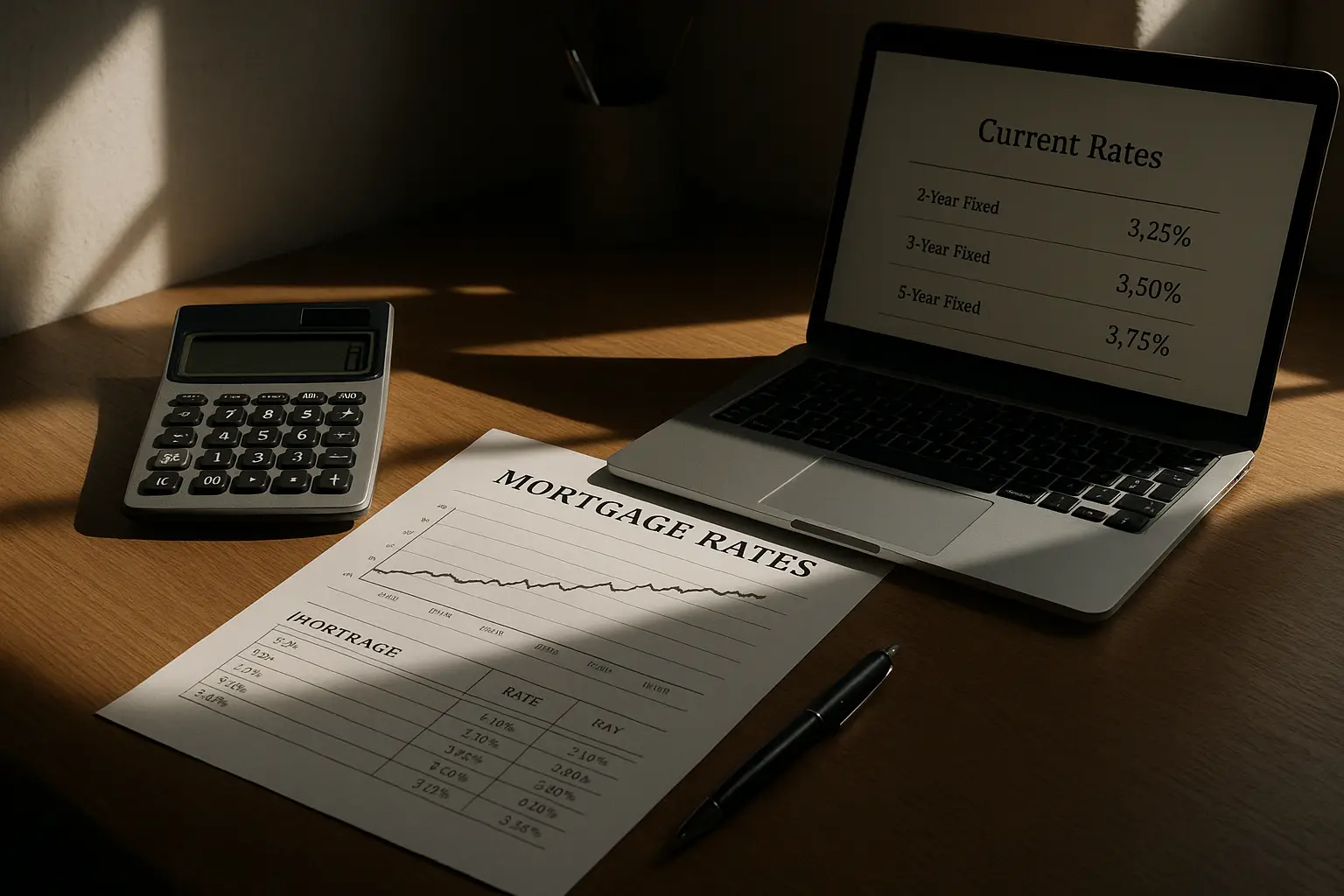

Understand mortgage types and rates

Mortgage types vary by repayment structure and rate stability, influencing long-term costs. Fixed rates offer predictability, while variable ones tie to broader interest rates. In 2025, understanding UK mortgage rates is key amid Bank of England adjustments.

Fixed vs variable rates

Fixed-rate mortgages lock in mortgage interest rates for 2-5 years, shielding against rises. Variable rates, like trackers, follow the base rate and can fluctuate. For stability, opt for fixed if planning long-term; variable suits those expecting cuts. Compare mortgage interest rates UK to see options—fixed often start at 4% for low LTV.

Current UK market trends

As of October 2025, the average two-year fixed mortgage rate for 75% LTV is about 4.2%, down from 5.5% in early 2024 due to rate cuts, per Which? (2025). Over 1.2 million homeowners face remortgaging, with 20% risking higher payments if trends reverse (HomeOwners Alliance, 2025). Monitor mortgage rates today via sites like Moneyfacts for real-time updates.

LTV and deposit impacts

A lower LTV (higher deposit) unlocks best mortgage rates, as it reduces lender risk. Aim for 10-20% deposit; first-time buyers represent 35% of 2025 mortgages, aided by schemes (Rest Less, 2025). Higher LTV means higher rates and possibly mortgage insurance.

| Lender | 2-Year Fixed (75% LTV) | 5-Year Fixed (75% LTV) | Fees |

|---|---|---|---|

| NatWest | 4.1% | 4.3% | £999 |

| HSBC | 4.0% | 4.2% | £1,099 |

| Halifax | 4.2% | 4.4% | £999 |

| Barclays | 4.1% | 4.3% | £995 |

Compare mortgage deals

To find the best mortgage deals, systematically review options beyond headline rates. Look at APRC (annual percentage rate of charge), which includes fees. Use tools for mortgage comparison to save time and money.

Use comparison sites

Sites like Compare the Market offer mortgage rates comparison for UK deals. Enter details for personalised results on fixed-rate mortgages UK. They cover 90+ lenders, helping spot incentives like cashback.

Evaluate fees and incentives

Beyond interest rates, check arrangement fees (£0-£2,000) and incentives like free valuations. A low-rate deal with high fees might cost more overall. For remortgagers, compare the market mortgages to avoid early repayment charges.

Shop around lenders

Don’t limit to your bank; major players like NatWest mortgage or HSBC mortgage rates vary. Independent sites provide unbiased views. Explore best mortgage rates UK via aggregators for tailored quotes.

Work with a mortgage broker

A mortgage broker accesses 90% of deals not available directly, potentially saving 0.3% on rates (Money To The Masses, 2025). They handle paperwork and negotiations for better outcomes.

Benefits of independent advice

Brokers like L&C Mortgages compare thousands of products, finding hidden gems. Free for borrowers (lenders pay), they save time on complex searches. Ideal for first-time buyers navigating schemes.

FCA-regulated options

Choose brokers authorised by the Financial Conduct Authority for protection. Check the FCA register to verify. Regulated advice ensures fair treatment under consumer rules.

Avoiding common pitfalls

Beware tied brokers pushing one lender; opt for whole-of-market independents. Read terms to avoid mis-selling. For details on best mortgage deals, consult expert guides.

Apply and negotiate

Once prepared, submit applications strategically. Timing affects rates, and negotiation can shave basis points.

Gather documents

Prepare payslips, bank statements, and ID for affordability checks. Proof of deposit sources is crucial. Lenders verify via the FCA’s mortgage statistics.

Timing your application

Apply when rates are low, like post-Bank of England cuts. Lock rates for 3-6 months to protect against rises. Monitor UK interest rates for optimal windows.

Securing the rate

Get an agreement in principle first, then full application. Negotiate by mentioning competitor offers. Brokers aid in rate matching.

Special considerations for first-time buyers

First-time buyers get tailored support in 2025. Focus on schemes and reliefs to ease entry.

Government schemes

Help to Buy offers up to 20% equity loans, reducing LTV. Shared ownership suits lower deposits. Check eligibility via government sites.

Stamp duty relief

No stamp duty on properties under £425,000 for first-time buyers. This saves thousands, boosting affordability.

Long-term affordability

Stress-test for rate rises; ensure payments fit 28% of income. Use calculators for what mortgage can I afford scenarios.

Frequently asked questions

What is a good mortgage rate in 2025?

A good mortgage rate in 2025 is below the average 4.2% for two-year fixed at 75% LTV, ideally 3.8-4.0% for strong profiles. This depends on LTV, credit score, and market trends influenced by UK interest rates. Shop around using comparison tools to find competitive offers from lenders like HSBC or Halifax, ensuring the APRC reflects total costs.

How does credit score affect mortgage rates?

Your credit score determines risk level, with scores above 800 unlocking the best mortgage rates by 0.5-1%, per MoneySavingExpert (2025). Lower scores lead to higher rates or rejections, as lenders factor in default risk. Improve it by reducing debt and timely payments; check free annually to address issues early for better eligibility.

When should I lock in a mortgage rate?

Lock in when rates are falling, like after Bank of England cuts, but avoid if more reductions seem likely. In 2025, with volatility, secure for 2-5 years if buying soon. Consult a broker for timing, as deals can expire in 6 months, protecting against unexpected hikes.

What are the best fixed-rate mortgages UK?

The best fixed-rate mortgages UK offer sub-4% for low LTV, like 3.9% two-year deals from major banks (Which?, 2025). Focus on whole-market comparisons for incentives. For remortgagers, 5-year fixes provide stability amid 1.2 million due in 2025 (HomeOwners Alliance).

How to compare mortgage deals?

To compare mortgage deals, use sites like Moneyfacts for rates, fees, and APRC side-by-side. Input your LTV and term for personalised results, evaluating fixed vs variable. Factor in broker access to exclusive offers; aim for overall savings, not just lowest headline rate.

Is now a good time to get a mortgage in 2025?

In late 2025, yes, with rates at 4.2% post-cuts, better than 2024’s 5.5%. However, watch for inflation; first-time buyers benefit from schemes. If remortgaging, act before deals expire to avoid standard variable rates over 7%.

What mortgage can I afford as a first-time buyer?

First-time buyers can afford 4-5 times income, up to £200,000+ with 5-10% deposits via schemes. Use a mortgage calculator UK to assess, factoring stamp duty relief under £425,000. Lenders stress-test at 7% rates; ensure 35% of new mortgages go to this group (Rest Less, 2025) by budgeting holistically.