Quick tip for applying for the best mortgage: Start by checking your credit score and gathering documents early to boost your chances of quick approval. This simple step can cut processing time significantly.

Applying for the best mortgage requires careful planning to secure favourable rates and fast approval. In the UK, where interest rates fluctuate with the Bank of England base rate, timing and preparation are key to avoiding delays and extra costs. This guide covers the best time to apply for a mortgage, top lenders, and strategies for swift processing, helping first-time buyers and remortgagers alike.

Best time to apply for a mortgage

The best time to apply for a mortgage is during periods of low interest rates and stable market conditions, often in the first quarter of the year. For 2025, experts predict optimal opportunities early in the year when rates are influenced by the Bank of England’s steady base rate of 4.75%.

Market timing factors

Economic indicators like inflation and employment data heavily influence when to apply for a mortgage. Monitor announcements from the Bank of England, as base rate cuts can lead to lower mortgage rates within weeks. For instance, a stable economy in early 2025 could mean sub-4% fixed rates become more accessible.

Seasonal trends in 2025

When is the best time to apply for a mortgage? Spring, particularly Q1 2025, sees lower competition and better deals as lenders clear previous year’s portfolios. According to MoneySavingExpert, UK mortgage rates are lowest in Q1 due to seasonal stability, avoiding the busier summer buying season.

Rate fluctuation impacts

What is the best time to apply for a mortgage considering rate changes? Apply before anticipated rises; for example, if inflation ticks up mid-year, lock in a fixed-rate deal. Rate fluctuations can add thousands to your costs over the term—checking MoneySavingExpert’s guide to cheap mortgages helps track trends.

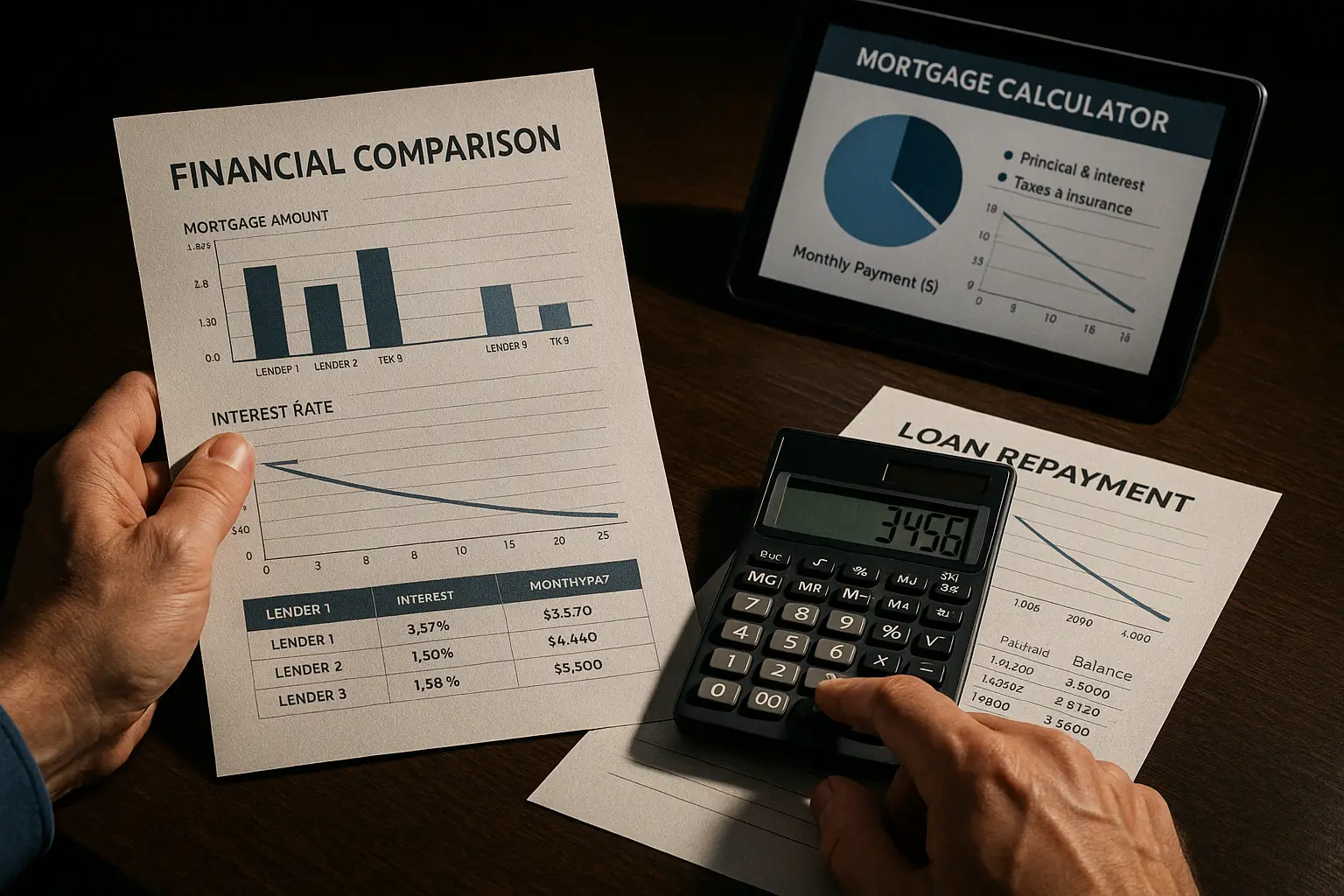

Best places and lenders to apply

The best place to apply for a mortgage is often through a broker, who accesses exclusive deals from multiple lenders. This approach suits those seeking the best banks to apply for a mortgage without exhaustive research.

Using mortgage brokers

Mortgage brokers compare options efficiently; 80% of first-time buyers use them in 2025, per Which?. They handle paperwork and negotiate rates, potentially saving time and money. For transparent advice, consult independent brokers registered with the Financial Conduct Authority.

Top UK banks and companies

Which are the best banks to apply for a mortgage? HSBC and Nationwide stand out with sub-4% rates for two-year fixed deals in late 2025, as noted by Compare the Market. Other strong options include Barclays and Lloyds, offering competitive loan-to-value (LTV) ratios— the percentage of the property value you can borrow.

| Lender | Average rate (2-year fixed) | Approval time | Pros | Cons |

|---|---|---|---|---|

| HSBC | 3.8% | 2-4 weeks | Fast online process; flexible LTV | Higher fees for remortgages |

| Nationwide | 3.9% | 3-5 weeks | Member perks; cashback offers | Strict credit checks |

| Barclays | 4.0% | 2-6 weeks | Digital tools; branch support | Limited specialist deals |

Online vs in-branch applications

The best places to apply for a mortgage include online platforms for speed, versus in-branch for personalised advice. Online applications via sites like Compare the Market take minutes to start, while branches suit complex cases. Hybrid options from best banks like Santander combine both for convenience.

Best ways to apply for quick approval

The best way to apply for a mortgage is to prepare thoroughly upfront, aiming for approval in as little as 10 days with proper documents. UK applications typically take 2-6 weeks, but proactive steps accelerate this.

Preparing your documents

Gather payslips, bank statements, and ID early—what documents do I need to apply for a mortgage? Preparing in advance can speed approval by up to 50%, according to Count Ready. Include proof of deposits and utility bills to verify affordability.

Improving credit score

Boost your credit score before applying; check it free via services like Experian. Pay off debts and correct errors to improve eligibility—higher scores unlock better rates. For tips on how to get the best mortgage deal, review our guide.

Application strategies

What is the best way to apply for a mortgage? Submit to multiple lenders via a broker to compare deals without impacting your credit. Use an Agreement in Principle (AIP) for pre-approval. Track current mortgage rates and compare mortgage deals for the optimal choice. For broader options, explore best mortgage deals.

Common mistakes to avoid

Avoid rushing without research, as it leads to rejections and credit dings.

Timing errors

Applying during peak seasons like summer increases competition and delays—plan for quieter periods.

Incomplete applications

Missing documents prolongs processing; double-check everything before submission.

Ignoring fees

Overlook arrangement fees or early repayment charges, which can inflate costs. Always review the Annual Percentage Rate (APR), which includes these.

This is not financial advice; consult a qualified advisor for personalised guidance.

Frequently asked questions

How long does mortgage approval take in the UK?

Mortgage approval in the UK usually takes 2-6 weeks from submission to offer, depending on the lender and your preparation. Factors like document completeness and credit checks influence speed; for first-time buyers, it averages 4 weeks per the UK Mortgage Centre. To expedite, use a broker who streamlines the process across lenders.

What documents do I need to apply for a mortgage?

Essential documents include three months’ payslips, six months’ bank statements, proof of deposit, and ID like a passport. Self-employed applicants need SA302 tax forms and accounts. Lenders also require utility bills for address verification—gathering these upfront prevents delays and demonstrates financial stability to underwriters.

When should I apply for a mortgage in 2025?

The best time to apply for a mortgage in 2025 is Q1, when rates are lowest due to Bank of England stability at 4.75%. Avoid late-year uncertainty from potential rate hikes. Monitor economic news; applying pre-budget announcements can secure deals before market shifts, saving on interest over the loan term.

Which UK banks offer the best mortgage rates?

HSBC and Nationwide lead with sub-4% two-year fixed rates in 2025, per Compare the Market. Barclays and Lloyds follow closely for competitive LTV options. Compare via brokers for personalised rates; customer satisfaction surveys from Which? highlight Nationwide’s reliability for quick approvals.

How can I improve my chances of quick mortgage approval?

Improve chances by checking and boosting your credit score, reducing debts, and preparing documents meticulously. Get an AIP early to gauge eligibility without commitment. Brokers can submit to multiple lenders efficiently—preparation cuts time by half, as expert estimates suggest, leading to offers in under two weeks.

What is the best way to apply for a mortgage loan?

The best way to apply for a mortgage loan is through an independent broker who accesses exclusive deals and handles paperwork. Start online for speed, then follow with a full submission. This method compares rates from best banks, ensuring you secure favourable terms while minimising credit impacts from multiple applications.

Where is the best place to apply for mortgage as a first-time buyer?

For first-time buyers, the best place to apply for a mortgage is via a whole-of-market broker, accessing schemes like Help to Buy. Platforms like MoneySavingExpert recommend this over direct bank applications for broader options. It ensures transparency on fees and rates, with 80% success in finding suitable deals.