This article is for informational purposes only and does not constitute financial advice. Always consult a qualified mortgage advisor before making decisions. Rates and deals can change rapidly, so verify the latest information from official sources.

How to compare mortgage deals

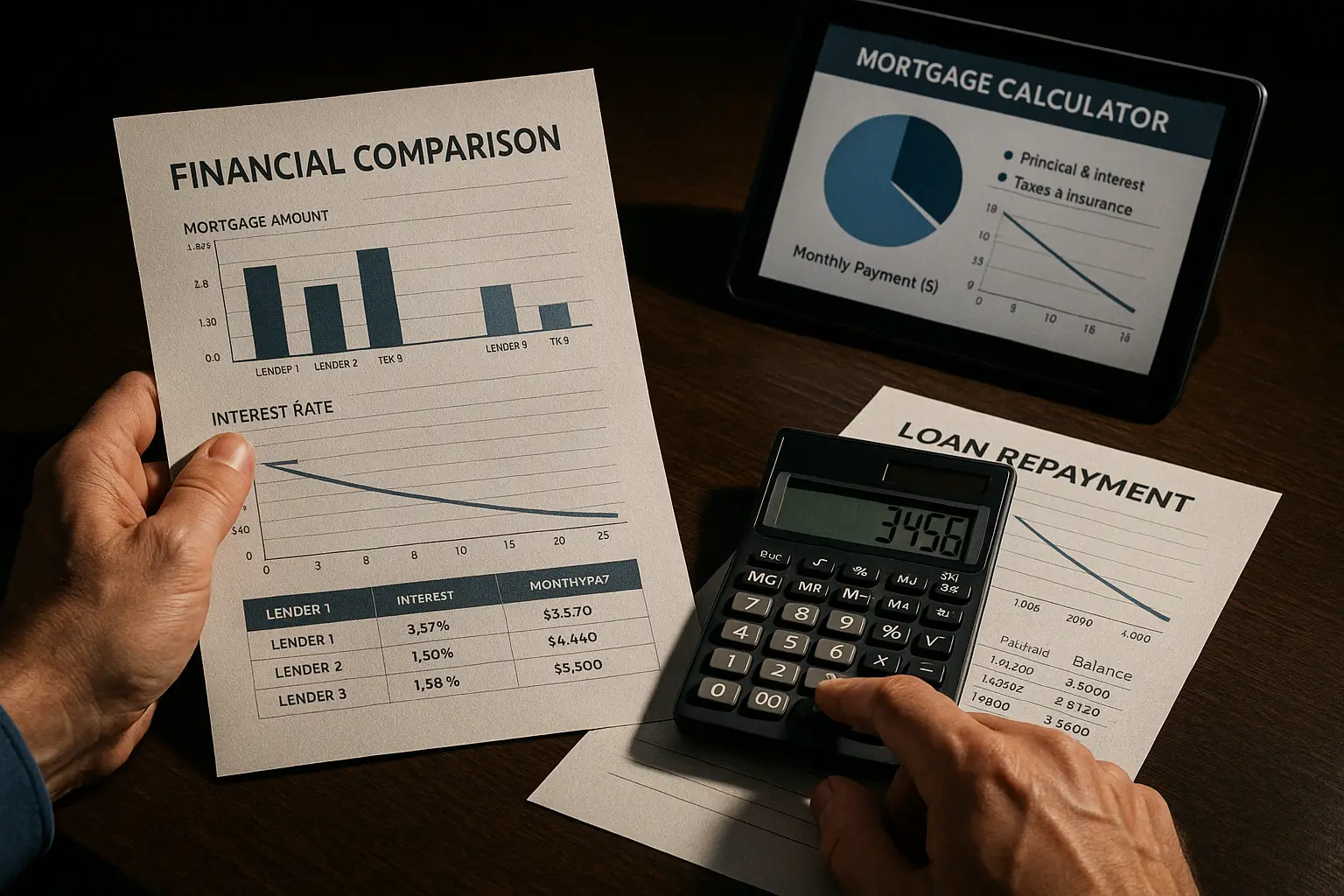

The key to comparing mortgage deals lies in evaluating not just the interest rate but also fees, loan-to-value (LTV) ratio, and overall annual costs to find the lowest effective rate for your needs. For instance, a seemingly low rate might come with high arrangement fees that increase the total cost over time. By using online tools and calculators, you can input your details—like deposit size and loan term—to see side-by-side comparisons that reveal the best mortgage deals tailored to UK borrowers.

### Factors to consider when comparing mortgage deals

When you compare mortgage deals, start with the interest rate, which determines your monthly repayments, but also check the LTV ratio—the percentage of your property’s value that you’re borrowing. A lower LTV often unlocks better rates, as lenders see it as lower risk. Other essentials include product fees (typically £0 to £2,000), early repayment charges, and incentives like cashback. For a £200,000 mortgage over 25 years, a 0.5% rate difference could save over £20,000 in interest.

### Step-by-step guide to comparing mortgage deals

First, assess your finances: calculate your affordability using a current mortgage rates guide to understand borrowing limits. Next, gather quotes from multiple lenders via comparison sites like those from Moneyfactscompare.co.uk. Then, use a mortgage calculator to project total costs, factoring in fees and potential overpayments. Finally, consult a broker for exclusive deals not available online.

Common pitfalls include ignoring standard variable rates (SVR), which can exceed 7% after fixed periods, or overlooking remortgaging costs. Always compare the total cost, not just headline rates.

Tip: Use a comparison checklist

- Interest rate and type (fixed vs. variable)

- Arrangement and valuation fees

- LTV requirements and incentives

- Early repayment penalties

- Overall APRC (annual percentage rate of charge)

This ensures you spot hidden costs when you compare mortgage deals online.

Best UK mortgage deals by type

In 2025, the best UK mortgage deals feature fixed rates averaging below 4% for competitive LTVs, making now an ideal time to compare mortgage deals UK-wide. Fixed-rate options provide stability, while buy-to-let (BTL) deals cater to investors with higher rates but tax advantages. First-time buyers can access schemes like Help to Buy, but always compare against remortgage options for existing homeowners.

### Fixed rate mortgage deals comparison

Fixed rate mortgages lock in payments for 2–5 years, protecting against rate hikes. As of November 2025, the average 2-year fixed rate is 4.02% and 5-year at 3.98% for 60% LTV, per HomeOwners Alliance data (source). Nationwide offers rates as low as 3.64% for select fixed products, slashing costs for qualifying borrowers (The Independent).

### Buy-to-let and first-time buyer options

To compare buy to let mortgage deals, focus on rental coverage ratios (typically 125–145% of rent) alongside rates around 4.5–5.5%. First-time buyers should compare first time buyer mortgage deals, often with 90–95% LTV and government-backed guarantees. For deeper insights on securing the top picks, see our guide on how to get the best mortgage deal.

| Lender | Rate | Fees | Monthly Payment | Annual Cost |

|---|---|---|---|---|

| Nationwide | 3.64% (5-year fixed) | £999 | £1,012 | £12,500 (approx.) |

| HSBC | 4.02% (2-year fixed) | £1,499 | £1,058 | £13,200 |

| Santander | 3.98% (5-year fixed) | £0 | £1,050 | £12,800 |

| NatWest | 4.10% | £995 | £1,065 | £13,100 |

| Halifax | 4.05% | £1,200 | £1,062 | £13,000 |

Data estimated from recent averages; use a tool for personalized quotes. Source: Inspired by MoneySavingExpert’s best buys (link).

For the latest on standout offers, explore best mortgage deals across the market.

Top comparison tools and calculators

Effective tools like Compare the Market and MoneySuperMarket let you compare the market mortgage deals quickly, filtering by rate, fees, and type. A mortgage calculator is essential for simulating scenarios—input your deposit, term, and income to see how deals stack up. Brokers such as L&C Mortgages offer free advice and access to 90+ lenders, ideal for complex cases like BTL.

To compare mortgage deals calculator options, sites like Moneyfacts provide daily updates. For free online comparisons, start with platforms that cover the whole UK market, including Scotland-specific rates.

Current mortgage rates and trends

UK mortgage rates have fallen below 5% for the first time since September 2022, driven by Bank of England base rate cuts (Moneyfacts, source). Before September 2025, rates hadn’t dipped under 5% since 2022 (The Mirror, link). Expect further drops if inflation eases, but track lender-specific offers like Nationwide’s reductions.

Niche deals: Buy-to-let, drawdown, and equity release

Comparing buy to let mortgage deals requires assessing higher stress rates (up to 8%) for affordability tests. For equity release, compare drawdown mortgage deals against home reversion plans—drawdown offers flexible withdrawals at lower initial costs. Use specialized calculators for these, as standard tools may not apply. Sites like Forbes Advisor UK cover BTL and equity options in depth (link).

Frequently asked questions

How do I compare mortgage deals?

Begin by listing key factors like interest rates, fees, and LTV when you compare mortgage deals. Use online platforms to input your details and generate side-by-side results, focusing on the APRC for a full picture. This approach helps UK borrowers avoid surprises, such as high SVRs post-fixed term, and can save thousands over the loan life.

What is the best way to compare mortgage rates?

The optimal method to compare mortgage rates involves using whole-of-market sites like MoneySavingExpert for unbiased lists. Factor in your LTV—lower ratios unlock sub-4% rates in 2025—and calculate total costs with a mortgage calculator. Expert strategy: Prioritise fixed rates for stability, especially with current trends showing averages at 3.98% for 5-years.

How to use a mortgage calculator for comparisons?

A mortgage calculator compares deals by estimating monthly payments and total interest based on rate, term, and amount. For advanced use, input variations like overpayments to see savings, or compare fixed vs. variable options. This tool is vital for first-time buyers assessing affordability against 90% LTV deals.

What fees should I consider when comparing deals?

When comparing mortgage deals, scrutinise arrangement fees (£500–£2,000), valuation costs, and exit penalties up to 5% of the balance. These can offset low rates, so calculate the true annual cost. For remortgagers, legal fees add £300–£1,500, making fee-free options attractive in a low-rate environment like 2025’s sub-5% averages.

Are there tools to compare buy-to-let mortgages?

Yes, platforms like Compare the Market offer BTL filters to compare buy to let mortgage deals by rate and coverage ratio. Brokers provide personalised tools for investors, factoring in rental yields. Risks include higher rates (4.5%+), so use calculators to ensure cash flow covers 125% of rent under stress tests.

Can I compare two mortgage deals effectively?

To compare two mortgage deals, use a side-by-side calculator focusing on APRC, which includes fees and rates for a 25-year term. Consider your timeline—short fixes suit rate fall expectations, while longer terms hedge uncertainty. Advanced tip: Model overpayments; a 1% lower rate on £200k could save £15,000, but weigh against tie-in periods.

How do I compare fixed rate mortgage deals UK?

Compare fixed rate mortgage deals UK by sorting on duration (2–5 years) and LTV via sites like Moneyfacts. Look for 2025 lows like 3.64% from major lenders, but balance with fees. For experts, analyse SVR reversion (often 6–7%) to avoid post-fix shocks, potentially remortgaging early if rates continue dropping.