Understanding savings accounts basics

A savings account is a secure place to store money while earning interest, designed for building financial stability rather than daily transactions. It allows you to deposit funds and watch them grow over time through interest payments from the bank. Unlike everyday banking, these accounts prioritise growth and protection for your cash.

Definition and purpose

At its core, a savings account is an interest-earning deposit account offered by banks or building societies where you can park money you don’t need immediately. The main purpose is to help individuals save for short- or long-term goals, such as an emergency fund, a holiday, or a house deposit. In the UK, these accounts are ideal for beginners looking to develop good saving habits without the risks of investing.

How interest is calculated

Interest on a savings account is typically calculated daily or monthly and added to your balance, often as compound interest where earnings generate further interest. Banks quote rates using AER (Annual Equivalent Rate), which shows the effective yearly return accounting for compounding. For example, a 4% AER on £1,000 would grow your savings to about £1,040 after one year, assuming no withdrawals.

Differences from current accounts

A savings account differs from a current account primarily in its focus: current accounts are for daily spending with features like debit cards and overdrafts, while savings accounts restrict access to encourage saving and offer higher interest rates. Current accounts usually pay little to no interest, whereas savings accounts can earn up to 4.5% AER on average for easy access options as of October 2025, according to MoneySavingExpert. Savings accounts also provide better protection under UK regulations for larger sums.

Types of savings accounts available in the UK

Savings accounts come in various types to suit different needs, from flexible access to fixed returns. The most common are easy access, fixed-rate, and specialised options like ISAs or child savings accounts. Choosing the right one depends on your saving goals and liquidity requirements.

Easy access accounts

Easy access savings accounts let you withdraw money anytime without penalty, making them perfect for emergency funds. They offer flexibility but typically lower rates than fixed options. As of 2025, the average rate is around 4.5% AER, allowing quick deposits and withdrawals while earning interest, as explained by the Mansfield Building Society.

Fixed-rate options

Fixed-rate savings accounts lock your money for a set period, such as one or two years, in exchange for a guaranteed interest rate. This suits savers who can commit funds and want predictable returns, often higher than easy access at up to 4.55% AER in 2025. However, early withdrawals may incur penalties.

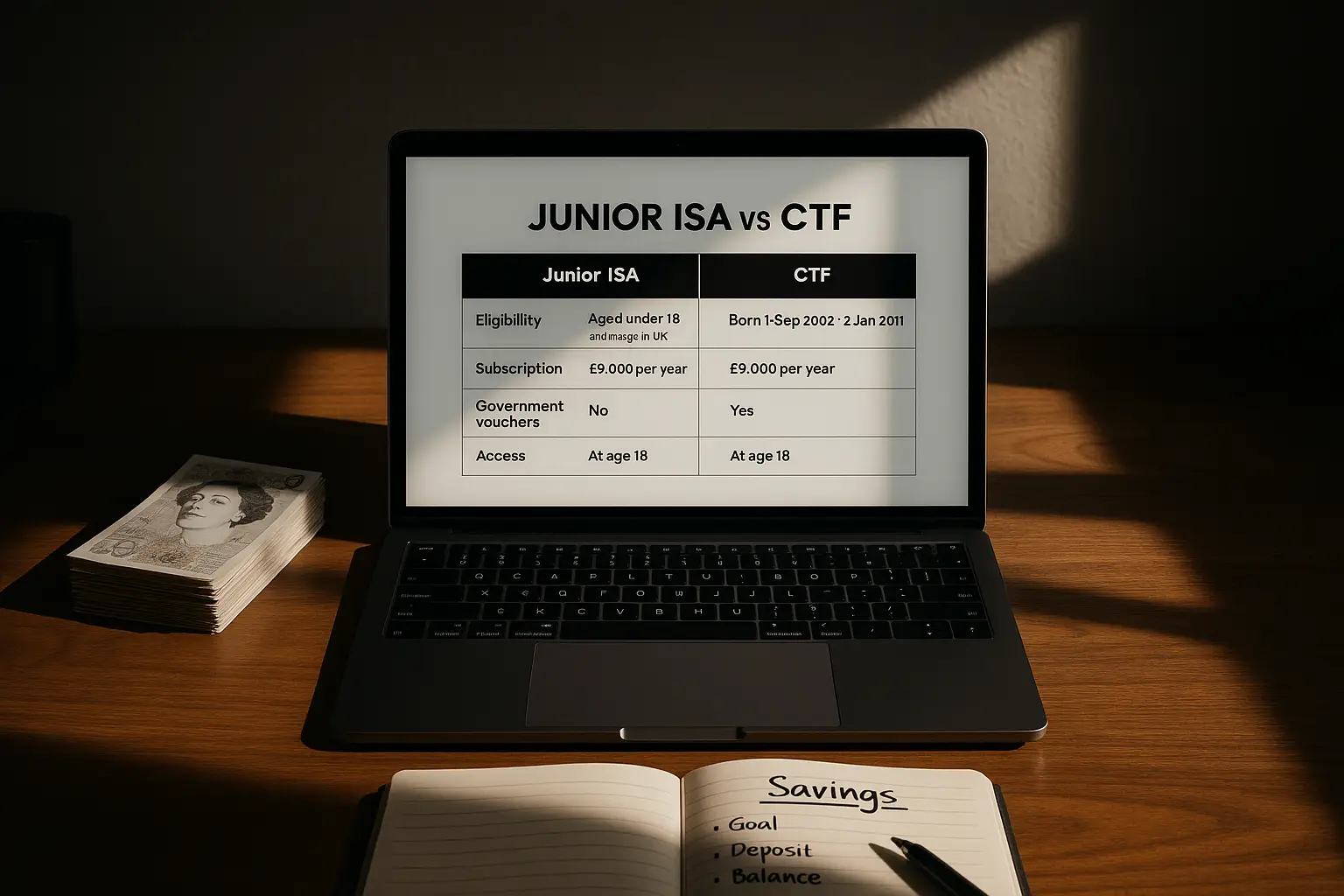

ISAs and child accounts overview

An individual savings account (ISA) is a tax-free wrapper around savings or investments, with a cash ISA variant functioning like a regular savings account but shielding interest from tax. Child savings accounts allow parents to save for minors, often with higher rates for smaller deposits. For tax-free benefits, explore more on cash ISAs via HMRC’s guidance.

| Type | Pros | Cons | Typical AER (2025) |

|---|---|---|---|

| Easy access | Flexible withdrawals; no lock-in | Variable rates; lower returns | 4.5% |

| Fixed-rate | Guaranteed rate; higher potential interest | Funds locked; penalties for access | 4.55% |

| Cash ISA | Tax-free interest; various access levels | Annual allowance limit (£20,000) | Up to 4.5% |

How savings accounts earn interest

Savings accounts earn interest by paying you a percentage of your balance as a reward for keeping money with the provider. Rates vary but compound over time to accelerate growth. In the UK, current rates make these accounts a low-risk way to beat inflation on your cash.

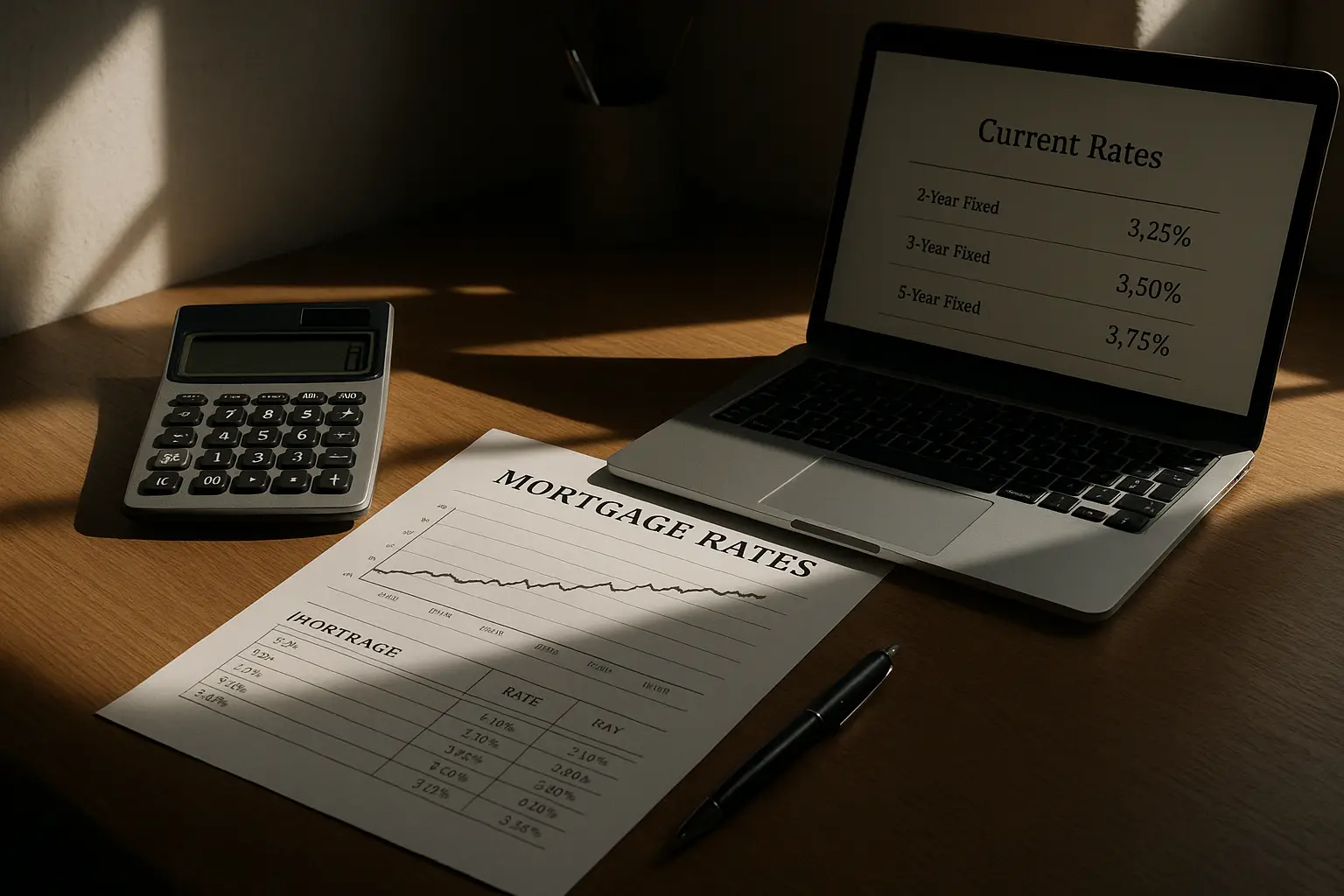

Current UK interest rate landscape

As of October 2025, easy access savings accounts average 4.5% AER, while regular savers can reach 7.5% for limited monthly deposits up to £250-£500. High interest savings accounts in the UK offer competitive returns, influenced by the Bank of England base rate. Check updates on Bank of England for the latest trends.

Factors affecting rates

Interest rates depend on market conditions, Bank of England policies, and provider competition. Fixed-rate accounts lock in rates, protecting against drops, while easy access rates can fluctuate. Longer terms often yield higher savings account interest rates.

Simple vs compound interest

Simple interest calculates only on the principal, while compound interest adds earnings to the balance for future calculations, leading to exponential growth. For a £1,000 deposit at 4% compound interest annually: Year 1: £1,040; Year 2: £1,081.60; Year 3: £1,124.86. This makes compounding powerful for long-term savings.

UK regulations, taxes, and protection

In the UK, savings accounts are regulated for safety, with tax rules like the Personal Savings Allowance (PSA) allowing tax-free interest up to £1,000 for basic-rate taxpayers. HMRC may send savings account tax letters if you exceed limits. Protection via the FSCS covers up to £85,000 per person per institution.

Personal Savings Allowance explained

The PSA lets basic-rate taxpayers earn £1,000 in interest tax-free annually, £500 for higher-rate, and none for additional-rate. This applies to all savings accounts, reducing tax burdens for most. Details are available on money.co.uk.

HMRC tax implications

Interest over your PSA is taxed at your income rate via self-assessment or PAYE adjustment. Premium bonds offer a tax-free alternative lottery-style savings option. Always track earnings to avoid unexpected HMRC savings account tax warnings.

FSCS safety net

The Financial Services Compensation Scheme (FSCS) protects savings up to £85,000 if the provider fails, providing peace of mind. This government-backed scheme covers UK-authorised banks like Nationwide, NatWest, and HSBC. Learn more at FSCS.gov.uk.

Getting started with a savings account

Begin by assessing your goals, then select an account from reputable providers. Opening is straightforward online or in-branch, requiring ID and proof of address. Start small to build the habit.

Choosing your first account

Consider accessibility, rates, and minimum deposits; easy access suits beginners. Providers like Nationwide savings accounts or NatWest savings accounts offer user-friendly options. For the best savings account overview, review trusted comparisons.

Opening process

To open: 1) Choose a provider and account type. 2) Provide personal details and ID (passport or driving licence). 3) Make an initial deposit via transfer. The process takes minutes online for most UK banks.

Tips for beginners

Joint savings accounts can be useful for couples sharing goals. Start saving today to build financial security.

Frequently asked questions

What is a savings account and how does it work?

A savings account is a bank product for depositing money to earn interest over time, separate from spending accounts. It works by calculating interest on your balance, often compounded, and crediting it periodically. In the UK, you can open one easily online, with funds protected up to £85,000 by the FSCS, making it a safe starting point for beginners building an emergency fund or future goals.

How much interest do savings accounts pay in the UK?

Savings account interest rates vary, with easy access accounts averaging 4.5% AER and fixed-rate up to 4.55% as of 2025. Regular savers can reach 7.5% for limited deposits. Rates depend on economic factors like the Bank of England base rate, so compare options to find suitable high interest savings account UK deals without risking accessibility.

What is the difference between a savings account and a current account?

A current account handles daily transactions with chequebooks and debit cards, paying minimal or no interest. Savings accounts focus on growth, offering higher rates but limited withdrawals to encourage saving. For UK users, this separation helps separate needs from wants, with savings earning meaningful returns like 4%+ AER.

Are savings accounts safe in the UK?

Yes, savings accounts are safe due to FSCS protection covering up to £85,000 per person per institution if the bank fails. Regulated providers like HSBC or NatWest adhere to strict rules. While interest rates fluctuate, the principal is secure, making them low-risk for beginners compared to stocks or crypto.

How does tax work on savings interest?

Under the Personal Savings Allowance, basic-rate taxpayers get £1,000 tax-free interest yearly, with lower allowances for higher bands. Excess is taxed at your income rate via HMRC, potentially triggering savings account tax letters. Opt for an ISA to make all interest tax-free up to £20,000 annually, ideal for maximising returns.

What is a joint savings account?

A joint savings account is shared by two or more people, like partners, for combined goals such as a home deposit. Both parties can deposit and withdraw, earning interest on the total balance. In the UK, it’s protected under FSCS per person, but coordinate to avoid disputes; it’s great for families but requires trust.

Should I choose an easy access savings account or fixed rate?

Easy access suits those needing flexibility, with rates around 4.5% AER but variable. Fixed-rate locks funds for higher guaranteed returns like 4.55%, penalising early access. Beginners should start with easy access for liquidity, switching to fixed once committed, balancing growth and access needs.