Understanding ISA types and benefits

Individual Savings Accounts (ISAs) allow UK residents to save or invest up to £20,000 tax-free each tax year, as confirmed by HMRC guidelines for the 2025/26 period (MoneySavingExpert, 2025). This £20,000 allowance applies across all ISA types, making them essential for anyone looking to grow savings without paying income tax or capital gains tax. With over 40% of UK adults holding more than £8,000 in savings according to recent polls, choosing the right ISA provider is key to maximising returns amid expected economic shifts like four base rate cuts in 2025 (Moneyfacts, 2025).

Cash ISAs

Cash ISAs offer low-risk savings similar to a bank account but with tax-free interest. They suit conservative savers prioritising capital protection under the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per provider. Top cash ISA providers UK focus on competitive rates, currently peaking at 4.51% AER (Annual Equivalent Rate, a standard measure of interest).

Stocks and shares ISAs

For higher potential returns, stocks and shares ISAs invest in funds, shares, or bonds, though with market risk. They appeal to those comfortable with volatility, offering diversification across thousands of options. Best stocks and shares ISA providers UK 2025 emphasise low fees under 0.45% and user-friendly apps (Kepler Trust Intelligence, 2025).

Lifetime ISAs

Lifetime ISAs target 18-39-year-olds saving for a first home or retirement, with a 25% government bonus on contributions up to £4,000 annually. Withdrawals for eligible purposes are tax-free, but penalties apply otherwise. Top lifetime ISA providers UK provide seamless bonus claims and flexible investments.

Junior ISAs

Junior ISAs help parents save for children under 18, with the full £9,000 allowance maturing tax-free at 18. They come in cash or stocks and shares variants. Top junior ISA providers UK offer educational tools and low-cost entry for long-term growth.

Tip: Start small – Even £50 monthly in a what is an isa can build significant tax-free wealth over time. Assess your risk tolerance before choosing between cash and investment options.

Top cash ISA providers 2025

The standout cash ISA options prioritise high rates and easy access, with providers like Chip, Plum, and Moneybox leading for app-based usability and customer ratings above 4.5/5 on Trustpilot. For instance, Trading 212’s cash ISA offers competitive yields with no minimum deposit, ideal for beginners.

Rate comparisons

Current top rates include 4.51% AER for fixed-term from providers like Shawbrook Bank, while easy-access options hover at 4-4.3% (Moneyfacts, 2025). Fixed rates lock in returns against the IMF’s predicted base rate cuts, but easy-access suits those needing liquidity. Compare via tables below for the best fit.

| Provider | Type | Rate (AER) | Min Deposit | Customer Rating |

|---|---|---|---|---|

| Chip | Easy Access | 4.2% | £1 | 4.6/5 |

| Plum | Easy Access | 4.1% | £100 | 4.5/5 |

| Moneybox | Fixed 1 Year | 4.5% | £500 | 4.4/5 |

| Trading 212 | Easy Access | 4.3% | £1 | 4.7/5 |

Provider reviews and pros and cons

Reviews highlight Chip’s intuitive app for automated savings, though some note slower customer service. Plum excels in eco-friendly features but limits withdrawals. Overall, these top cash ISA providers UK 2025 balance rates with FSCS protection. For deeper insights on best isa rates, explore current benchmarks.

- Pros: Tax-free growth, high liquidity options, strong protections.

- Cons: Rates may fall with base cuts; inflation could erode real returns.

Moneyfacts’ ISA comparison tool updates rates daily for accuracy.

Best stocks and shares ISA providers

Leading platforms like AJ Bell, Hargreaves Lansdown, and Vanguard top lists for 2025, offering over 3,000 funds with fees as low as 0.15% (Kepler Trust Intelligence, 2025). They provide ready-made portfolios for hands-off investing, appealing to intermediate users.

Fee structures

Low-cost leaders charge 0.25% annually plus trading fees under £10, minimising erosion on returns. Compare to high-street banks’ 1%+ fees for significant savings over time.

Investment choices and user ratings

Vanguard shines with index funds tracking global markets, earning 4.5/5 for simplicity. AJ Bell offers tools for active traders. Top stocks and shares ISA providers UK prioritise educational resources, with 80% user satisfaction in Which? surveys.

MoneySavingExpert’s platform guide details cheap vs premium options.

Leading lifetime and junior ISA options

For lifetime ISAs, providers like Moneybox and Nutmeg lead with bonus handling and hybrid cash/investment accounts, suiting first-time buyers (Tembo Money, 2025). Junior options from Fidelity and Vanguard focus on low fees for child-focused growth.

Eligibility and bonuses

Lifetime ISAs require under-50s; bonuses apply instantly. Juniors need a UK child resident. Top lifetime ISA providers UK 2025 integrate these seamlessly.

Provider recommendations and long-term suitability

Nutmeg’s robo-advisory scores high for automation, while Fidelity’s juniors offer 2,000+ funds. Reviews praise transparency but warn of 6.25% withdrawal penalties for non-qualifying use.

Which?’s ISA ratings cover eligibility in depth.

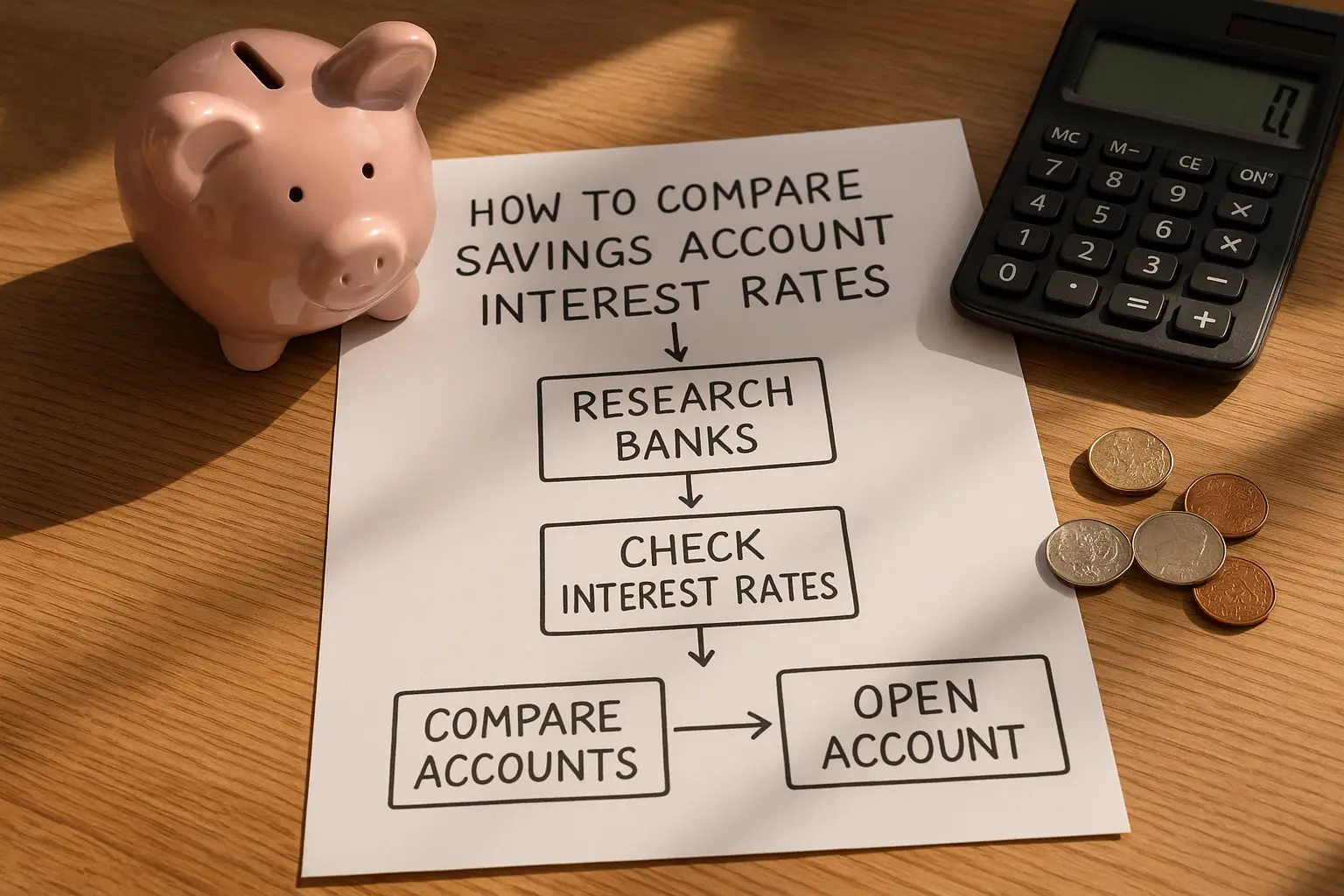

How to choose the right ISA provider

Prioritise providers matching your goals: rates for savers, fees for investors. Evaluate app usability, customer service (aim for 4+/5 ratings), and FSCS coverage. Transferring ISAs is free and preserves tax-free status – contact your new provider to initiate.

Key factors to consider

Check for types of isa accounts, minimums, and exit fees. Use tools from Kepler Trust Intelligence.

Transferring ISAs and common pitfalls

Transfers take 15-30 days; avoid cashing out to prevent tax issues. Pitfalls include ignoring inflation or over-investing without diversification.

Tip: Diversify – Split your £20,000 allowance across isa limits 2025 types for balanced risk. Consult a financial advisor for personalised advice.

This guide is for informational purposes only and not financial advice. Rates and allowances can change; verify with providers.

Frequently asked questions

What are the best ISA rates right now?

As of October 2025, top cash ISA rates reach 4.51% AER for fixed terms, while easy-access options average 4.1-4.3% from providers like Chip and Trading 212. These rates reflect current Bank of England base levels but could decline with the four expected cuts this year, per IMF forecasts. For stocks and shares, focus on net returns after fees under 0.45%, as potential growth outpaces cash amid inflation.

How do I choose an ISA provider?

Start by defining your goals – safety for cash or growth for investments – then compare rates, fees, and reviews on sites like MoneySavingExpert. Look for FSCS protection and app features for ease. Beginners should opt for low-minimum providers like Plum to test waters without commitment.

What’s the difference between cash and stocks ISAs?

Cash ISAs provide guaranteed interest with principal protection, ideal for short-term needs, while stocks and shares ISAs offer higher potential via market investments but with value fluctuation risks. Cash suits risk-averse savers earning steady 4%+ AER, whereas stocks appeal to long-term investors averaging 5-7% historical returns. Both shield gains from tax, but diversify to mitigate downsides.

Which ISA provider has the lowest fees?

Vanguard and AJ Bell lead with platform fees around 0.15-0.25% for stocks and shares ISAs, far below Hargreaves Lansdown’s 0.45%. For cash, many like Chip charge zero fees, focusing on rate competitiveness. Low fees preserve more returns over time, especially for larger pots near the £20,000 allowance.

Can I transfer my ISA to another provider?

Yes, transfers are straightforward and maintain tax-free status without using your annual allowance. Instruct your new provider (top 10 ISA providers UK like Moneybox handle this seamlessly) to move funds directly, typically within 30 days. Avoid withdrawing cash yourself to prevent tax charges; it’s free for most but check for exit fees on fixed products.

What is the best ISA provider for beginners?

Moneybox and Trading 212 stand out for intuitive apps, no minimums, and educational tools, earning 4.5+ ratings for user-friendliness. They offer hybrid cash/stocks options to ease into investing without overwhelm. For pure savings, Chip’s automation simplifies building habits towards the £20,000 limit.

Are ISA rates expected to change in 2025?

With four base rate cuts forecasted by the IMF, cash ISA rates may drop from 4.51% AER to around 3-4% by year-end, affecting variable products more than fixed ones. Lock in rates now via top cash ISA providers UK 2025 for stability. Stocks and shares remain less tied to rates, focusing on market performance for resilient growth.