What is a junior ISA?

A junior ISA, or Junior Individual Savings Account, is a tax-free savings account designed for children under 18 in the UK. It acts as a long-term savings vehicle where parents or guardians can contribute on behalf of their child, with funds locked until the child turns 18. Unlike regular savings accounts, any growth from interest or investments is free from UK income tax and capital gains tax, making it ideal for building a nest egg.

Eligibility and how to open one

Any UK resident child under 16 can have a junior ISA opened by a parent or legal guardian; for 16- to 17-year-olds, the child can open it themselves. There are two types: cash junior ISAs, which offer steady interest like a savings account, and stocks and shares junior ISAs, which invest in funds or shares for potentially higher returns but with more risk. To open one, choose a provider authorised by the Financial Conduct Authority (FCA) and complete an online application with the child’s details—no National Insurance number is needed until age 16. For more on what is a junior isa, check our basics guide.

Contribution limits and types

For the 2025/26 tax year, the annual limit is £9,000, which can be split between cash and stocks types if desired (source: GOV.UK Junior ISAs overview). Contributions come from anyone, not just the parents, and unused allowance doesn’t roll over. Over 6.5 million junior ISAs have been opened since 2012, with an average balance of £2,100 as of 2024 (source: MoneySavingExpert).

Access rules at age 18

The child gains full control at 18, when the account converts to an adult ISA or can be withdrawn. Until then, the guardian manages it, ensuring disciplined saving. This structure promotes long-term savings without early temptation to spend.

What is a child trust fund?

A Child Trust Fund (CTF) is a government-backed, tax-free savings account for children born between 1 September 2002 and 2 January 2011. Introduced to encourage saving, each eligible child received a £250 voucher from the government to start the account, with higher amounts up to £500 for lower-income families. Though the scheme ended in 2011, existing CTFs continue to grow tax-free.

History and who qualifies

The CTF scheme was part of a UK initiative to give every child a financial head start, but it was replaced by junior ISAs in 2012 due to budget cuts. Only children born in that specific window qualify; for example, if your child was born in 2005, they likely have a matured or maturing CTF. Nearly 1 million CTFs remain untouched as of 2023, potentially missing growth opportunities (source: Wealthify blog).

Current status for existing holders

Parents can still contribute up to £6,000 annually to an existing CTF, but rates are often lower than modern options. At age 18, the child accesses the funds fully, similar to a junior ISA. To locate a forgotten CTF, use the official ShareFinder service via HMRC.

Government voucher details

The initial voucher was invested in stakeholder accounts, which balanced growth and security. Additional top-ups were encouraged, but without the scheme, many accounts sit idle, highlighting the need to review and possibly transfer.

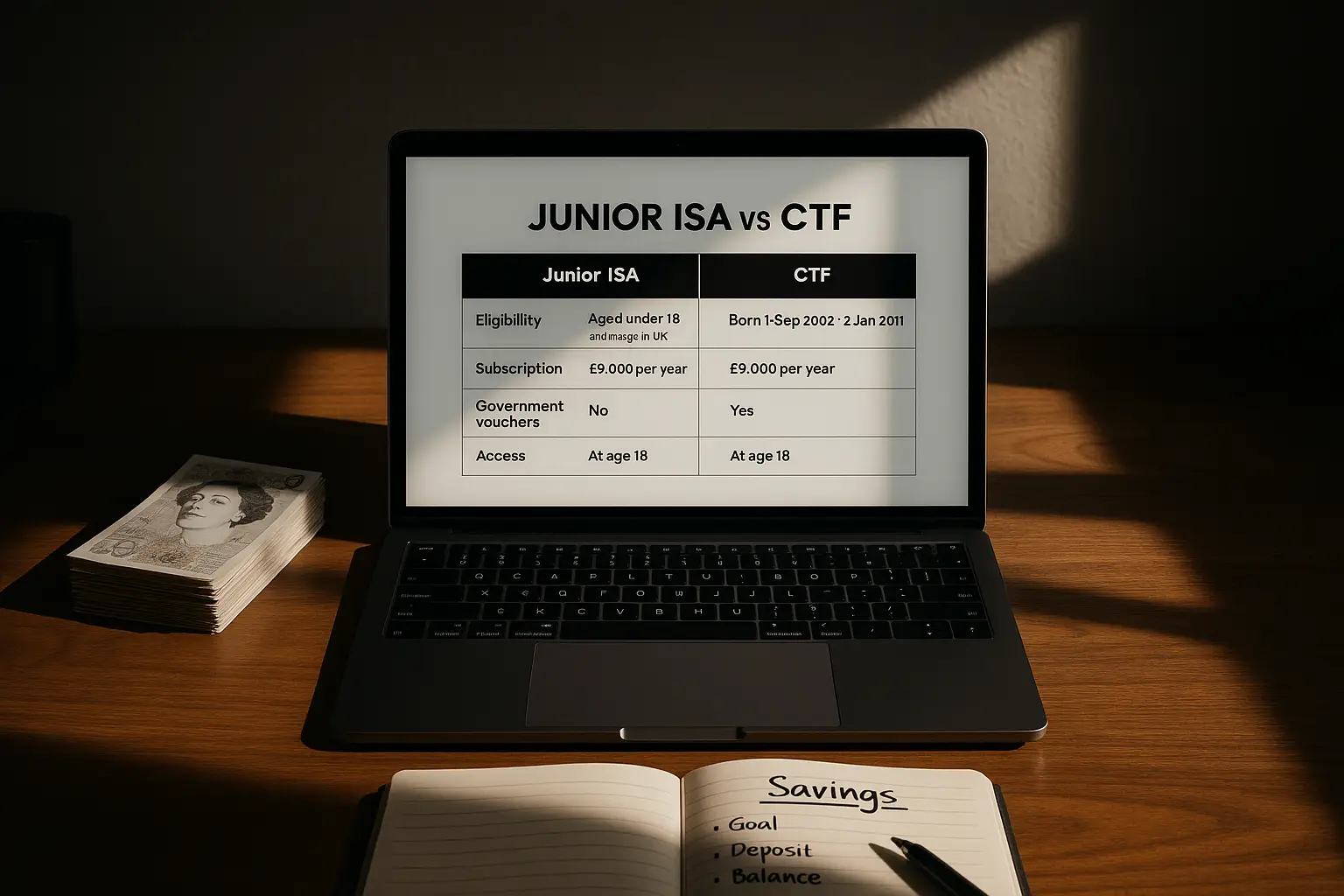

Junior ISA vs child trust fund: Key differences

When comparing junior ISA vs child trust fund, the main distinctions lie in eligibility, flexibility, and growth potential—junior ISAs offer broader access and higher limits, making them better for new savers, while CTFs suit existing holders seeking simplicity. Both are tax-free wrappers, but junior ISAs provide more investment choices and better returns on average. The difference between junior ISA and child trust fund often boils down to when your child was born and your saving goals.

Tax and growth comparisons

Both avoid tax on gains, but junior ISAs allow up to £9,000 yearly contributions versus CTFs’ £6,000 cap. Stocks and shares variants in junior ISAs historically outperform CTFs, which are stuck with older, lower-yield options. For instance, child trust fund vs ISA returns show junior ISAs averaging 4-5% annually against CTFs’ 2-3% (based on historical data from providers).

| Feature | Junior ISA | Child Trust Fund |

|---|---|---|

| Eligibility | Children under 18, UK residents | Born 2002-2011 only |

| Annual limit (2025) | £9,000 | £6,000 |

| Tax-free growth | Yes, until 18 | Yes, until 18 |

| Transfer options | Can transfer CTF to JISA | Can transfer to JISA |

| Average returns | Up to 5% (stocks) | 2-3% (stakeholder) |

Flexibility and transfer options

Junior ISAs offer cash or stocks choices, while CTFs are more rigid. You can transfer a CTF to a junior ISA tax-free, preserving benefits and accessing better rates, but only one junior ISA per child is allowed (source: MoneySavingExpert CTF guide). Transfers are free in most cases, though some providers charge exit fees up to 1%.

Pros and cons for long-term savings

- Junior ISA pros: Higher limits, more providers, better growth potential for junior ISA long term savings.

- Cons: No government starter if born post-2011.

- CTF pros: Automatic setup for eligible kids, low maintenance.

- Cons: Lower caps, outdated options limit returns.

Tip: If your child has a CTF, consider transferring to a junior ISA for higher contributions and investment choices. Always check provider fees first to avoid surprises—this can boost growth by 2-3% annually.

Which is better for long-term savings?

For most families, a junior ISA edges out as better for long-term savings due to its flexibility and higher limits, especially for children born after 2011. However, if you have an existing CTF, transferring makes sense to consolidate and optimise growth. Ultimately, junior ISA vs child trust fund depends on your child’s age and your risk tolerance—both build wealth tax-free, but junior ISAs align better with 2025’s economic landscape.

Scenarios for choosing junior ISA

Opt for a junior ISA if starting fresh or seeking stocks for compound growth; for example, £50 monthly at 5% could reach £18,000 by 18 (source: The Guardian 2025 projections). It’s ideal for parents wanting control until handover.

When to stick with or transfer CTF

Keep a high-performing CTF if fees are low, but transfer for junior ISA eligibility UK rules that allow better diversification. The process involves contacting your CTF provider and selecting a junior ISA—takes 2-4 weeks.

Long-term projections and tips

Projections show junior ISAs growing faster; for low-risk, choose cash variants. To maximise, contribute regularly and review annually. For the best junior isa options, explore our reviews. Remember, this is not financial advice—consult a professional or OneFamily’s comparison for personalised guidance.

Frequently asked questions

What’s the difference between a junior ISA and a child trust fund?

The key difference between junior ISA and child trust fund is availability and features: junior ISAs are open to all under-18s with higher £9,000 limits, while CTFs are legacy accounts for 2002-2011 births capped at £6,000. Junior ISAs offer more investment flexibility, like stocks for higher potential returns, whereas CTFs are simpler but often yield less. For parents deciding on junior ISA vs child trust fund, the former suits modern saving needs better due to updated rules from HMRC.

Can I transfer a child trust fund to a junior ISA?

Yes, you can transfer a child trust fund to a junior ISA without losing tax-free status, allowing access to higher contributions and better rates. The process starts by finding your CTF provider via GOV.UK, then applying to a junior ISA provider who handles the switch—typically free, but check for exit fees. This is especially useful for child trust fund transfer to junior ISA if the current account underperforms, potentially adding thousands in growth over time.

Are junior ISAs better than child trust funds?

Junior ISAs are generally better for long-term savings due to higher limits and investment options, outperforming CTFs in returns—e.g., 5% vs 3% average. However, if your child qualifies for a CTF and it’s already invested well, sticking might suffice until transfer. Weigh junior ISA eligibility UK against your goals; for new savers, junior ISAs win on flexibility and 2025 projections showing stronger growth.

How do I find my child’s child trust fund?

To find your child’s child trust fund, use the free CTF ShareFinder service on GOV.UK, providing basic details like name and birthdate—it locates the provider in minutes. If unsuccessful, contact NS&I or major banks as many hold CTFs. Once found, review the balance; nearly 1 million are untouched, so acting now via transfer can unlock better opportunities like junior ISAs.

What happens to child trust funds at 18?

At 18, the child gains full access to the child trust fund, which matures and can be withdrawn or transferred to an adult ISA to maintain tax benefits. No automatic conversion occurs, so plan ahead to avoid taxable implications if moved to a regular account. This milestone encourages responsibility, but for optimal long-term strategy, consider rolling into an adult ISA for continued growth.

What is junior ISA eligibility in the UK?

Junior ISA eligibility UK requires the child to be under 18 and a UK resident; parents open for under-16s, or the teen can for themselves. No minimum income needed, and anyone can contribute up to the £9,000 limit. This broad access makes it a go-to for tax-free saving, unlike limited CTFs—verify via GOV.UK for any residency updates.