Lifetime ISA vs regular ISA: which one should you pick?

When comparing a lifetime ISA vs a regular ISA, the key decision hinges on your savings goals—whether you’re aiming for a first home deposit, retirement, or general tax-free growth. A lifetime ISA offers a 25% government bonus but comes with restrictions and penalties for unauthorised withdrawals, making it ideal for long-term home or pension saving. Regular ISAs provide more flexibility across cash, stocks and shares, or innovative types, with a £20,000 annual allowance for the 2025-26 tax year, suiting diverse needs without the bonus incentive. For first-time buyers or those under 50, a lifetime ISA could boost your pot significantly, but for unrestricted access, a regular ISA wins.

What is a lifetime ISA?

A lifetime ISA is a tax-free savings account designed for long-term goals like buying your first home or saving for retirement. You can open one if you’re a UK resident aged 18 to 39, with contributions allowed until age 50, up to £4,000 per year—the government adds a 25% bonus on that amount, maximising at £1,000 annually. This makes it a powerful tool for first-time buyers, as in 2024-25, 87,250 holders withdrew for property purchases, averaging £23,000 per withdrawal, according to HMRC data.

Eligibility and rules

To qualify, you must not own a home worth over £450,000 and use withdrawals penalty-free for a first home under that value or after age 60. Unauthorised withdrawals incur a 25% charge, which could eat into your original deposit. For detailed rules, see the official guidance on GOV.UK’s lifetime ISA overview.

Government bonus explained

The 25% bonus applies only to your contributions, not existing funds or transfers, and is paid within 30 days. For example, contribute £4,000 and receive £1,000 free, turning it into £5,000 instantly. As noted by MoneySavingExpert, this has delivered a £1bn net gain to the Treasury since 2021, projected to reach £4bn by 2040.

Cash vs stocks and shares variants

- Cash lifetime ISA: Low-risk, with rates up to 4.30% AER as of October 2025, ideal for stable saving.

- Stocks and shares lifetime ISA: Higher potential returns but with market risk, often featuring platform fees around 0.25%.

Choose based on your risk tolerance—for conservative savers, cash wins; for growth, stocks and shares.

What is a regular ISA?

A regular ISA, or Individual Savings Account, allows tax-free interest, dividends, and capital gains up to £20,000 yearly across various types. Unlike the lifetime ISA, there’s no bonus but full flexibility for withdrawals anytime without penalty, making it versatile for short- or long-term saving. To learn more about what a lifetime ISA entails in comparison, it’s essentially a specialised regular ISA with added incentives.

Types of regular ISAs

Options include cash ISAs for easy access or fixed rates, stocks and shares for investments, and innovative ISAs like Lifetime or Help to Buy. You can split your allowance across types, including both a lifetime ISA and others.

Annual allowance and flexibility

The £20,000 limit covers all ISAs, with lifetime contributions counting towards it. Withdrawals are free and flexible, unlike the lifetime ISA’s restrictions. Which? highlights that multiple ISAs can be held simultaneously for diversified saving.

| Feature | Lifetime ISA | Regular ISA |

|---|---|---|

| Annual contribution | £4,000 + 25% bonus | Up to £20,000 |

| Withdrawal penalties | 25% charge (non-qualifying) | None |

| Best for | First home or retirement | General flexible saving |

| Age eligibility | 18-39 to open | No age limit |

Lifetime ISA vs Help to Buy ISA

The lifetime ISA replaced the Help to Buy ISA in 2019, offering a higher bonus rate and dual purpose for home or retirement, making it generally better for new savers. While Help to Buy provided 25% on £12,000 max (£3,000 bonus), it closed to new entrants, but existing holders can transfer to a lifetime ISA for continued growth.

Bonus and limits

Lifetime ISA’s 25% on £4,000 yields £1,000 yearly, versus Help to Buy’s £200 max. Martin Lewis on MoneySavingExpert recommends transferring for the ongoing bonus. For first-time buyers, this transition boosts deposits significantly.

Eligibility for first-time buyers

Both target homes under £450,000, but lifetime ISA adds retirement flexibility. Pros of lifetime ISA: higher lifetime bonus potential (£32,000 max); cons: age limit and penalties vs Help to Buy’s simplicity.

Lifetime ISA vs stocks and shares ISA

A lifetime ISA vs stocks and shares ISA differs in restrictions—the former locks funds for specific goals with a bonus, while the latter offers unrestricted investment access and higher allowance. Choose stocks and shares for pure growth without penalties, or lifetime if home-buying motivates you.

Risk and return differences

Both can invest in stocks, but lifetime ISAs carry withdrawal risks, potentially deterring short-term traders. Average returns vary, but lifetime’s bonus offsets some market volatility for long-haul savers.

Best for home vs investment

- Lifetime for house deposit with bonus boost.

- Stocks and shares for flexible portfolio building.

You can hold both, using the full £20,000 allowance.

Lifetime ISA vs cash ISA

In a lifetime ISA vs cash ISA comparison, the former adds a bonus for restricted saving, while cash ISAs prioritise liquidity with competitive rates up to 4.30% AER. Opt for cash ISA if you need immediate access; lifetime for incentivised long-term growth.

Cash lifetime ISAs combine both benefits but with penalties—ideal if committed to goals. Differences include bonus vs full flexibility; no penalties in standard cash ISAs make them safer for emergencies.

Lifetime ISA vs pension or SIPP

A lifetime ISA vs SIPP (Self-Invested Personal Pension) balances flexibility against tax relief—SIPPs offer up to 45% relief on contributions for higher earners, but funds lock until 55, versus lifetime ISA’s earlier access for homes and 25% bonus. For retirement-focused savers over 40, SIPP edges out; under 39 with home plans, lifetime ISA shines.

Tax benefits comparison

SIPPs provide upfront relief, growing tax-free, with 25% tax-free withdrawal at pension age. Lifetime ISAs are fully tax-free but bonus-limited. As per expert views, combine both for optimal retirement strategy.

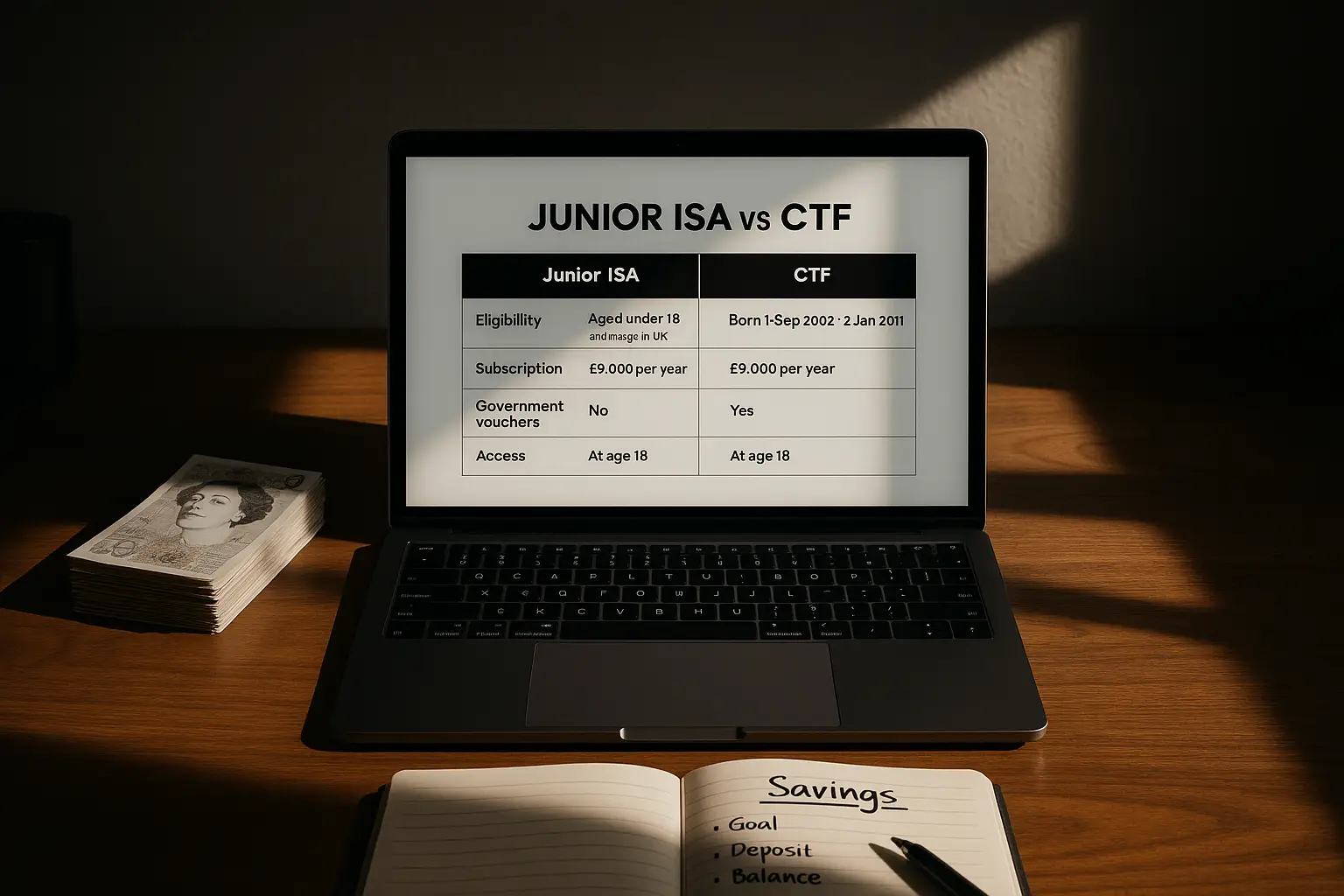

Other ISA alternatives

Beyond core types, consider junior ISAs for children, offering £9,000 annual tax-free saving until 18, versus lifetime ISA’s adult focus. Premium Bonds provide prize-based saving without interest, low-risk but no guaranteed returns. For non-ISA options like overpaying mortgages, weigh against lifetime ISA’s tax perks—consult providers for personalised advice.

To get started, explore the best lifetime ISAs and learn how to open a lifetime ISA. For rates, check Moneyfacts’ lifetime ISA comparisons.

Frequently asked questions

What is the difference between a lifetime ISA and a regular ISA?

The main difference in lifetime ISA vs regular ISA lies in purpose and incentives: lifetime ISAs target first homes or retirement with a 25% government bonus on up to £4,000 yearly, but impose a 25% withdrawal penalty for non-qualifying uses. Regular ISAs, like cash or stocks and shares, allow the full £20,000 allowance with no penalties or bonuses, offering greater flexibility for everyday saving or investing. This makes lifetime ISAs suited to specific long-term goals, while regular ones fit broader needs, as explained on MoneySavingExpert.

Can I have both a lifetime ISA and a stocks and shares ISA?

Yes, you can hold a lifetime ISA alongside a stocks and shares ISA, as long as total contributions stay under £20,000 per tax year. This strategy diversifies your savings: use the lifetime ISA for bonus-boosted home or pension funds, and stocks and shares for unrestricted growth. GOV.UK confirms multiple ISAs are permitted, helping balance restricted incentives with flexible investments.

Is a lifetime ISA better than a Help to Buy ISA?

A lifetime ISA is often better than the now-closed Help to Buy ISA for new savers, offering the same 25% bonus plus retirement use, with higher lifetime limits (£32,000 vs £3,000 bonus). Existing Help to Buy holders should transfer to access ongoing bonuses, as advised by Which?. However, if you’re over 39 or need simpler access, sticking with matured Help to Buy funds might suit better, avoiding lifetime ISA penalties.

What are the withdrawal penalties for a lifetime ISA?

Lifetime ISA withdrawal penalties include a 25% charge on the entire amount withdrawn, not just gains, potentially losing your original deposit if the bonus was claimed. This applies before age 60 or for non-first-home purchases over £450,000; exceptions cover terminal illness or close relatives’ death. As per official rules, plan carefully to avoid this, especially for cash variants where rates like 4.30% AER add value over time.

How much government bonus do you get on a lifetime ISA?

You receive a 25% government bonus on contributions up to £4,000 annually, equalling £1,000 free money each year, claimable from age 18 to 50. This bonus applies only to new money, not transfers, and enhances first-home deposits—87,250 used it in 2024-25 for averages of £23,000. Moneyfacts notes it’s a key draw, but eligibility requires UK residency and no prior home ownership.

Lifetime ISA vs SIPP: which is best for retirement?

For retirement, a SIPP often outperforms a lifetime ISA due to higher contribution limits (£60,000 annual) and tax relief up to 45% for higher-rate taxpayers, though access starts at 55 with only 25% tax-free. Lifetime ISAs offer earlier withdrawal from 60 fully tax-free, plus the 25% bonus, suiting younger savers balancing home and pension goals. Experts suggest SIPPs for pure retirement focus, lifetime for dual-purpose with bonus leverage, per AJ Bell insights.

What happens if I withdraw from a lifetime ISA before age 60?

Withdrawing before 60 from a lifetime ISA triggers a 25% penalty on the full withdrawal amount, reclaiming the government bonus plus an equivalent from your savings, which could result in net loss. For first-home buys under £450,000, it’s penalty-free regardless of age; otherwise, it’s for retirement only post-60. GOV.UK warns this deters short-term use, so align with long-term plans like the 56,900 who used it successfully for homes in 2023-24.