What makes the best online savings accounts

The best online savings accounts in 2025 offer competitive annual equivalent rates (AER) up to 4.75% for easy access options, providing higher yields than traditional high street banks while ensuring FSCS protection up to £85,000. These accounts stand out for their digital convenience, allowing instant transfers and 24/7 management via apps, which appeals to savvy UK savers seeking security and growth. Unlike physical branches, online providers like Chase and Cynergy Bank focus on transparency and low fees, making them ideal for building emergency funds or short-term goals.

Key features to look for

When evaluating the best savings accounts online, prioritise AER, which represents the true interest earned annually including compounding, minimum deposits often as low as £1, and unlimited withdrawals for easy access types. Look for no monthly fees and mobile apps with budgeting tools to track growth effortlessly. For instance, top picks include variable rates that adjust with Bank of England changes, ensuring your money works harder without lock-ins.

Online versus traditional banks

Online savings accounts best rates surpass traditional banks by up to 1-2% due to lower overheads, with providers like Atom Bank offering 4.6% AER compared to high street averages below 2%. Traditional options provide in-person support but often lag in yields and accessibility, while online versions enable quick switches via the Current Account Switch Service. For UK residents, this shift means more flexibility without sacrificing convenience.

Safety and FSCS protection

All reputable best online savings accounts UK are protected by the Financial Services Compensation Scheme (FSCS), safeguarding up to £85,000 per person per institution if the provider fails. This government-backed scheme ensures your funds are secure, similar to FDIC in the US, with no need for private insurance. Always verify the provider’s authorisation via the FCA register for peace of mind.

Top easy access online savings accounts

The highest easy access rates hit 4.75% AER in 2025, perfect for those needing liquidity without penalties, as reported by MoneySavingExpert on 22 October 2025. These best instant access online savings accounts UK allow withdrawals anytime, ideal for emergency funds, with providers like RCI Bank updating rates daily for competitiveness.

Highest AER rates

Leading the pack, accounts from Moneybox and Plum offer 4.75% AER with no minimum deposit, beating the 4.56% average from Moneyfactscompare’s 22 October 2025 data. These variable rates track base rate cuts, but locking in now secures strong returns amid economic shifts.

Best for beginners

For newcomers, Chase Saver at 3.99% AER (as of 2025) integrates seamlessly with current accounts for automatic transfers, building habits without complexity. It’s FSCS-protected and app-based, making the best online savings accounts monthly interest straightforward for those starting small.

Comparison table

| Account Provider | AER (%) | Minimum Deposit | Access Type | FSCS Protected |

|---|---|---|---|---|

| RCI Bank Freedom Savings | 4.75 | £100 | Easy Access | Yes |

| Moneybox | 4.75 | £1 | Easy Access | Yes |

| Plum | 4.75 | £1 | Easy Access | Yes |

| Chase Saver | 3.99 | £0 | Easy Access | Yes |

| Cynergy Bank | 4.6 | £1 | Easy Access | Yes |

Data sourced from MoneySavingExpert’s best savings accounts guide and Moneyfactscompare, accessed 22 October 2025. Rates may vary; check for updates.

For more on best savings rates, explore our pillar guide.

Best fixed-rate and regular saver options

Fixed-rate bonds yield up to 4.55% AER for one-year terms, locking in returns for those comfortable without access, per Which?’s 2025 analysis. Regular savers boost to 7.5% AER with monthly deposits, suiting disciplined savers aiming for higher yields.

1-year fixed bonds

Top one-year fixed options from Shawbrook Bank at 4.55% AER require £1,000 minimum, offering stability against rate drops. These best online fixed rate savings accounts prevent withdrawals but guarantee returns, outperforming easy access for medium-term goals.

Regular savers up to 7.5%

First Direct’s regular saver hits 7.5% AER on £25-£300 monthly deposits, limited to 12 months, as detailed by MoneySavingExpert (22 October 2025). Penalties apply for misses, but it’s ideal for habit-building with superior rates.

ISA integration

Many online savers pair with Cash ISAs for tax-free growth up to £20,000 annually. Consider a best regular savings accounts online within an ISA wrapper to maximise allowance without tax on interest.

Niche accounts: Business, child, and high-yield

Specialised accounts cater to specific needs, with business options at 3-4% AER and child accounts via Junior ISAs up to 4.5%, filling gaps in general comparisons.

Business savings rates

For firms, Metro Bank’s Business Saver offers competitive online business savings accounts best rates around 3.5% AER, with flexible access and no fees. These suit cash flow management, protected under FSCS for eligible deposits.

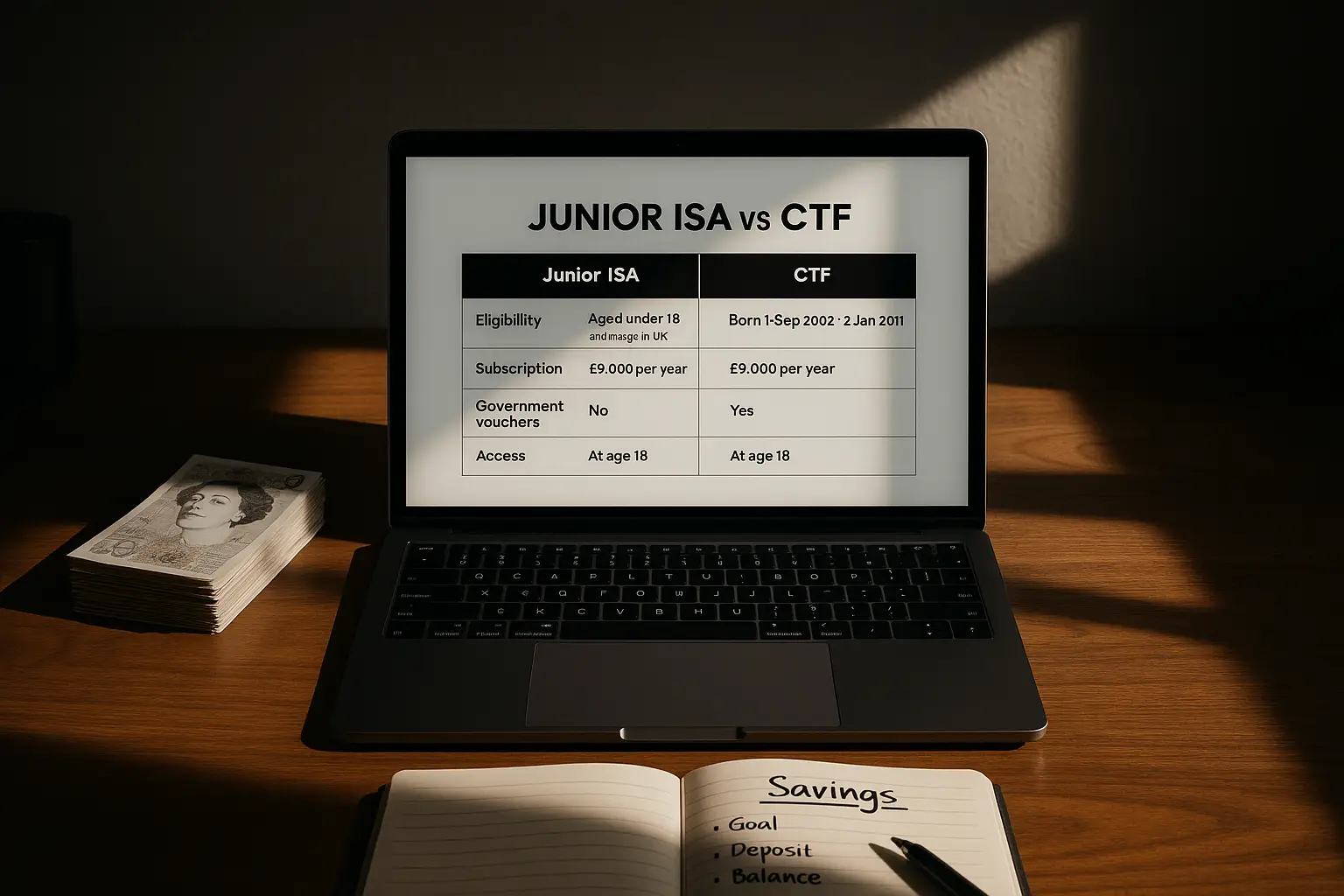

Junior accounts for kids

Best online child savings accounts include Coventry Building Society’s kids’ saver at 4% AER, or Junior ISAs for tax-free growth until 18. They’re low-risk, encouraging early saving with parental controls.

For insights on high yield savings accounts, see our dedicated article. To learn how to find high interest savings accounts, check this guide.

US versus UK high-yield comparison

UK AER tops at 4.75% for easy access, close to US APY of 4.51% from NerdWallet (22 October 2025, source), but FSCS edges FDIC for UK focus. US options like Ally may offer perks, yet UK provides better integration for residents.

How to choose and switch online savings

Assess your goals—liquidity for easy access or yield for fixed—using tools like Moneyfactscompare to compare best rates for online savings accounts, potentially boosting returns by 2%.

Rate calculators

Online calculators from money.co.uk (up to 4.6% as of 2025) estimate growth; input balance and term for projections. Factor in compounding for accurate best interest rates online savings accounts views.

Tax considerations

Interest counts toward your £1,000 personal savings allowance (basic rate taxpayers); exceed it, and tax applies. Pair with ISAs to avoid this, linking to tax-free options.

Switching process

Use the free switching service for seamless transfers in seven days. Close old accounts post-move, monitoring for bonuses in new best online instant access savings accounts.

For the latest current savings rates, visit our overview.

Frequently asked questions

What is the best online savings account?

The best online savings account depends on needs, but for 2025, easy access options like RCI Bank’s at 4.75% AER top lists for balance of yield and flexibility, as per MoneySavingExpert. They offer FSCS protection and app-based management, outperforming traditional savings with minimal effort. Beginners should start here for quick setup and growth tracking.

Which bank has the highest interest rate for savings?

In the UK, providers like Moneybox lead with 4.75% AER on easy access accounts, surpassing high street banks, according to Moneyfactscompare’s daily updates. Fixed options from Shawbrook reach 4.55% for one year, ideal for locking rates amid volatility. Always compare via tools to ensure the highest aligns with your access requirements.

Are online savings accounts safe?

Yes, best online savings accounts UK are safe when FSCS-eligible, covering up to £85,000 per provider against failures. Regulated by the FCA, they match high street security without physical risks, with two-factor authentication enhancing digital protection. Avoid unregulated platforms to maintain this safeguard.

What is a high-yield savings account?

A high-yield savings account pays above-average interest, like 4.75% AER in the UK, versus 1-2% standard rates, focusing on growth via compounding. These online versions minimise fees for maximum returns, suiting long-term savers. In the US, equivalents hit 4.51% APY, but UK AER provides similar benefits with local protections.

How do I choose the best savings account UK?

Evaluate AER, access type, and minimums against goals—easy access for liquidity or fixed for yields—using comparisons from Which?. Consider tax implications and switch easily for better rates. For niches like children, opt for Junior ISAs to build future security.

What are the best rates for online savings accounts in 2025?

Top rates include 7.5% AER on regular savers from First Direct, with easy access at 4.75%, per 2025 data from MoneySavingExpert. These vary by provider; monitor for base rate impacts. Business and child variants offer 3-4.5%, emphasising diversification for optimal yields.

Can I open a best online child savings account?

Yes, parents can open accounts like the best online child savings accounts through building societies, often as Junior ISAs with up to 4% AER tax-free. They teach saving while growing funds until adulthood, with FSCS cover. Compare options for low minimums and educational apps to engage kids early.