What are tax-free savings accounts?

Tax-free savings accounts allow UK residents to earn interest without paying income tax on it, helping savers keep more of their money. These accounts, primarily Individual Savings Accounts (ISAs), shield your savings from HMRC taxation on interest, dividends, or capital gains up to an annual limit. In a time when interest rates are rising, utilising tax-free options can significantly boost your returns.

Definition and benefits

A tax-free savings account is a financial product where the growth is exempt from tax, unlike standard savings accounts where interest over certain thresholds is taxable. The main benefit is preserving your full earnings; for instance, with current rates around 4.5% AER (Annual Equivalent Rate, the standard way to measure interest), a £10,000 deposit could earn £450 tax-free annually. This is particularly valuable amid economic uncertainty, as UK households deposited a record £103 billion into ISAs in the 2023-24 tax year due to fears of allowance cuts, according to The Guardian.

Difference from taxable accounts

In taxable accounts, interest is subject to income tax once you exceed the Personal Savings Allowance (PSA), which provides £1,000 tax-free for basic-rate taxpayers. Tax-free accounts like ISAs bypass this entirely, offering unlimited tax relief within the £20,000 annual limit for 2025/26. For example, higher-rate taxpayers get only £500 PSA, making ISAs essential to avoid a 40% tax hit on excess interest.

Who qualifies?

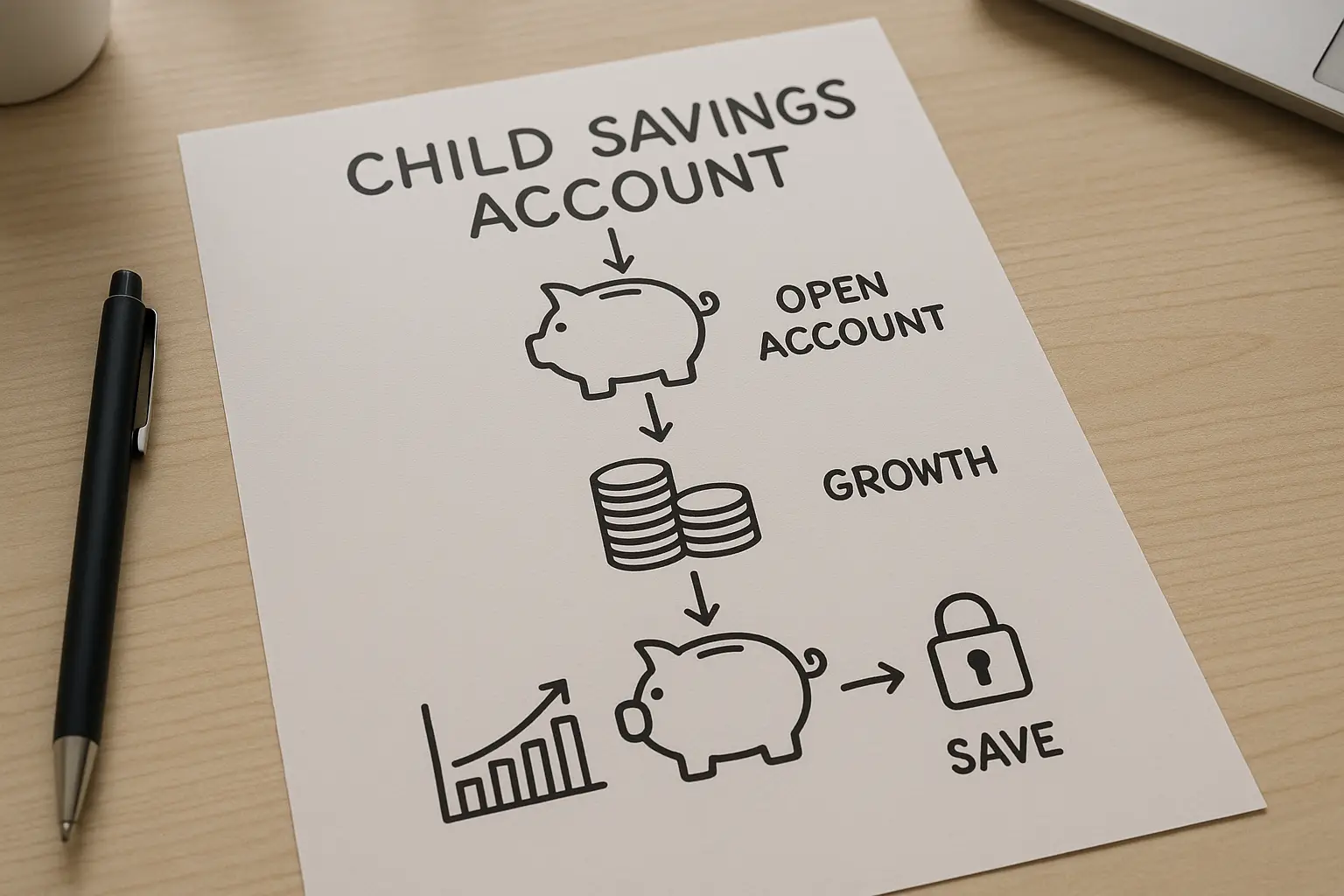

UK residents aged 18 or over can open a tax-free savings account, with no upper age limit. You must have a National Insurance number and be a UK taxpayer, though non-taxpayers can still benefit. For family savers, options like Lifetime ISAs suit younger adults, while parents might combine with tax-free childcare schemes for broader planning.

Tip: Check your tax band on your last payslip to estimate PSA benefits before opting for an ISA.

Types of tax-free savings options

The core tax-free savings options in the UK revolve around ISAs, each suited to different needs. These accounts ensure all growth is tax-free, with the total allowance shared across types at £20,000 per tax year (6 April to 5 April).

Cash ISAs

Cash ISAs function like regular savings accounts but with tax-free interest. Ideal for low-risk savers, they offer easy access or fixed terms. Top rates reach 4.5% AER for easy-access as of October 2025, per MoneySavingExpert.

Stocks and shares ISAs

These allow investments in stocks, funds, or bonds with tax-free gains. Suitable for those comfortable with market risk, returns can exceed cash but fluctuate. No tax on dividends or capital gains makes them powerful for long-term growth.

Lifetime ISAs

For 18-39 year-olds saving for a first home or retirement, Lifetime ISAs offer 25% government bonus on contributions up to £4,000 annually. Interest and gains are tax-free, but early withdrawals incur penalties except for eligible uses.

Innovative finance ISAs

These wrap peer-to-peer loans or crowdfunding, providing tax-free interest often higher than cash ISAs (around 5%). They carry more risk, so they’re best for diversified portfolios.

Personal savings allowance explained

The Personal Savings Allowance (PSA) offers tax-free interest on non-ISA savings, complementing ISAs for those under limits. Introduced in 2016, it protects most savers but not all.

How much interest is tax-free

Basic-rate taxpayers (income £12,571-£50,270) earn £1,000 tax-free interest annually. Higher-rate (£50,271-£125,140) get £500, while additional-rate taxpayers receive £0. For example, at 4% interest on £25,000, a basic-rate saver stays under £1,000, avoiding tax.

Tax bands and limits

Your tax band determines PSA: use HMRC’s guidance to confirm. Savings outside ISAs count towards this; exceeding it means 20%, 40%, or 45% tax on the excess.

2025/26 updates

No changes to PSA for 2025/26, but ISA allowance stays at £20,000, as confirmed by Tax Rebate Services. With 15 million new ISA accounts opened in 2023-24, demand surges amid policy talks.

| Provider | Rate (AER) | Type | Minimum Deposit |

|---|---|---|---|

| Plum | 4.5% | Easy-access Cash ISA | £0 |

| Shawbrook Bank | 4.55% | 1-year Fixed Cash ISA | £1,000 |

| NS&I | 4.4% | Premium Bonds (tax-free prizes) | £25 |

Best tax-free savings rates for 2025

Rates vary by type and term; compare via tools for the interest rate that fits your goals. Easy-access suits flexibility, fixed for security.

Top easy-access accounts

Leaders like Chip at 4.46% offer instant withdrawals. These beat standard savings, especially post-Base Rate hikes.

Fixed-rate options

For locked savings, 1-year deals hit 4.55%. Longer terms (5 years) yield up to 4.2%, per Money To The Masses.

How to choose

Assess risk, access needs, and FSCS protection (£85,000 per provider). For the best savings account, prioritise AER and terms; use ISA for full tax-free.

How to open and manage a tax-free account

Opening is straightforward online; manage via apps for tracking. Start with your tax year allowance to maximise benefits.

Step-by-step guide

- Choose provider via comparison sites like MoneyHelper.

- Provide ID and NI number online.

- Deposit up to £20,000; monitor via statements.

Common mistakes

Exceeding allowance forfeits tax relief on excess; always track contributions. Ignoring fees or variable rates can erode gains.

Transferring existing savings

Move old ISAs tax-free to better rates; providers handle it. This preserves allowance and boosts returns without new contributions.

Frequently asked questions

How much interest can I earn tax-free?

The Personal Savings Allowance lets basic-rate taxpayers earn £1,000 in interest tax-free from non-ISA savings, higher-rate £500, and additional-rate none, as per HMRC 2025 rules. ISAs offer unlimited tax-free interest up to your £20,000 contribution limit, making them ideal for larger pots. Calculate potential earnings using online tools; for £20,000 at 4.5% AER, that’s £900 fully protected from tax.

What is a tax-free savings account?

A tax-free savings account, typically an ISA, is a UK product where interest, dividends, and gains grow without income tax liability. Opened with banks or investment firms, it suits conservative savers seeking guaranteed returns or investors chasing growth. Unlike regular accounts, it eliminates HMRC claims on earnings, maximising net income in a high-rate environment.

Are ISAs tax-free?

Yes, all ISAs are completely tax-free on qualifying investments, including cash, stocks, and innovative finance, within the annual allowance. No capital gains or dividend tax applies, confirmed by GOV.UK guidelines. However, contributions are from post-tax income, so they’re not tax-deductible like pensions.

How does the personal savings allowance work?

The PSA automatically applies to non-ISA savings interest, taxing only excess over your band limit at your marginal rate. For strategies, combine with ISAs to exceed PSA without penalty; basic-rate savers with £50,000 outside ISAs might owe on interest above £1,000. Risks include forgetting to report via self-assessment if over limits, potentially leading to fines.

What are the best tax-free savings options in 2025?

Top picks include easy-access Cash ISAs at 4.5% from providers like Plum, or fixed-rate at 4.55% from Shawbrook, based on October 2025 data. For advanced users, Stocks and Shares ISAs via low-fee platforms like Vanguard offer diversified growth potential up to 7% average annually, minus volatility. Compare via eligibility and goals; Lifetime ISAs add bonuses for under-40s buying homes.

Are premium bonds tax-free?

Yes, winnings from Premium Bonds are tax-free prizes, not interest, so no PSA applies. Backed by NS&I, they’re a low-risk lottery-style option with 4.4% prize fund rate. Ideal for conservative savers, though returns aren’t guaranteed; hold up to £50,000 for monthly draws.

How much savings interest is tax-free for higher earners?

Higher-rate taxpayers get £500 PSA on non-ISA interest, taxed at 40% beyond that. To optimise, max ISAs first for unlimited tax-free growth; on £10,000 at 4%, that’s £400 protected via ISA versus potential £240 tax on excess PSA. Advanced comparison: pair with salary sacrifice pensions for further relief, but consult rules to avoid over-contribution.

Ready to start saving tax-free? Compare options and open an account today to secure your financial future.