What is a cash ISA and how does it work?

A cash ISA is a tax-free savings account available to UK residents, allowing you to save up to £20,000 each tax year without paying income tax on the interest earned. Introduced in 1999 as part of the Individual Savings Accounts (ISAs) framework by HMRC, it works like a regular savings account but with the key advantage of tax exemption, making it ideal for beginners looking to grow their money securely. To open one, you must be 18 or over and a UK resident; simply choose a provider, deposit funds, and watch your savings earn interest tax-free.

Eligibility requires a National Insurance number and UK tax residency, while withdrawals depend on the account type—some allow instant access, others lock funds for a fixed period. Unlike standard savings, cash ISAs shield interest from tax, which is particularly beneficial if you earn over the personal savings allowance of £1,000 for basic-rate taxpayers. For more on official rules, see the GOV.UK guide to ISAs.

Different types of cash ISAs

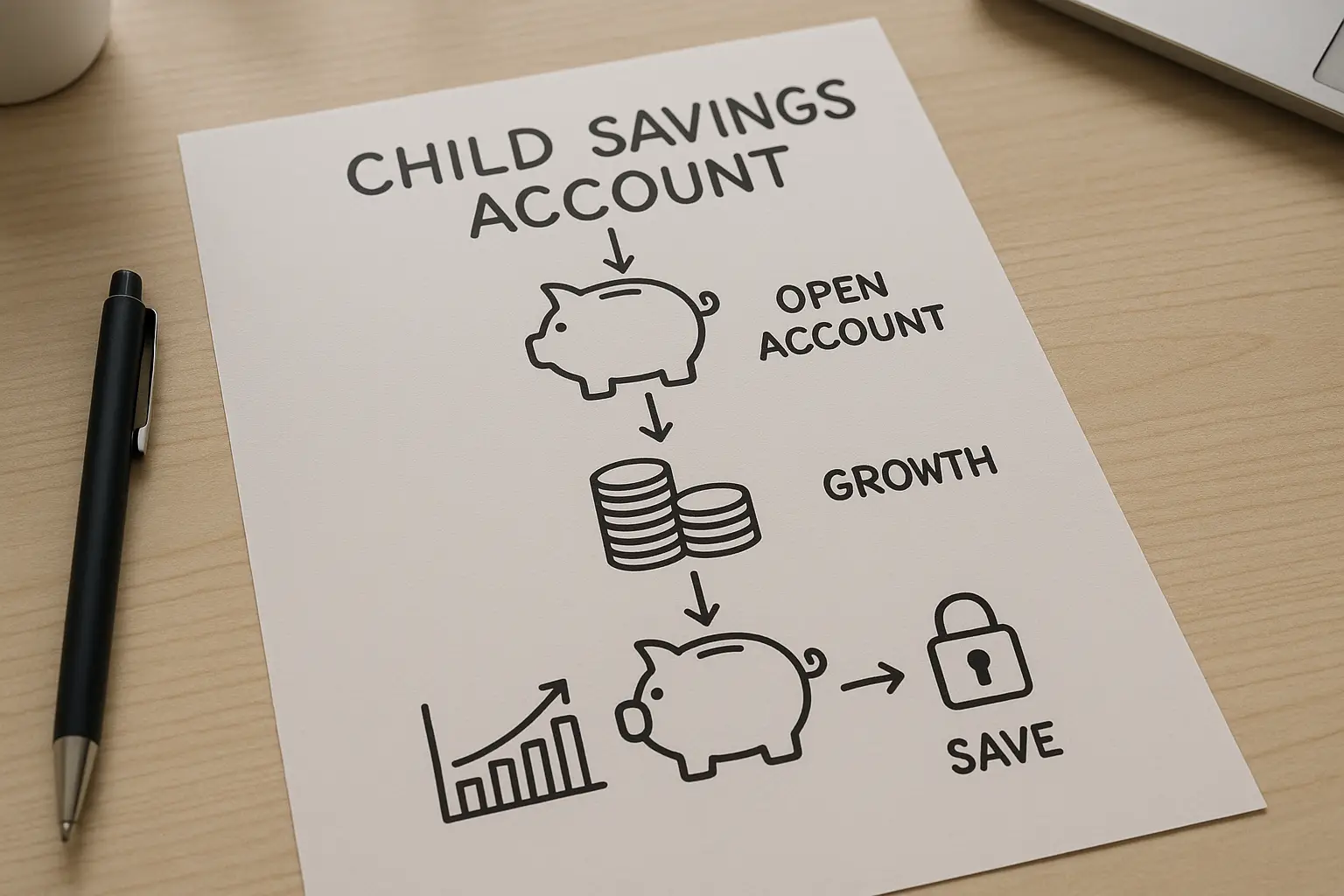

Cash ISAs come in various forms to suit different needs, from easy access for flexibility to fixed-rate options for guaranteed returns. The main types include easy access (variable rate) for everyday use, fixed-rate cash ISAs that lock in interest for stability, and flexible cash ISAs allowing withdrawals and replacements without affecting your annual allowance. Special variants like the cash Lifetime ISA help first-time buyers or retirees save with a government bonus, while junior cash ISAs are for children under 18.

Here’s a comparison table of key types:

| Type | Key Features | Best For |

|---|---|---|

| Easy Access (Variable Rate Cash ISA) | Instant withdrawals, interest rate can change | Short-term savers needing liquidity |

| Fixed Rate Cash ISA | Locked term (e.g., 1 year), guaranteed rate | Those wanting predictable returns |

| Flexible Cash ISA | Withdraw and redeposit within the year | Flexible budgeting |

| Cash Lifetime ISA | 25% government bonus, for home or retirement | Aged 18-39 planning major goals |

| Junior Cash ISA | For under-18s, £9,000 annual limit | Parents saving for children’s future |

What is a fixed cash ISA? It’s essentially a fixed-rate version that secures your rate against market fluctuations. For legacy options like the Help to Buy Cash ISA, note they’re closed to new savers but transferable.

Cash ISA allowance and contribution limits

The annual ISA allowance for 2025/26 is £20,000, covering all ISA types including cash ISAs, with no lifetime limit on total holdings as long as you stay within yearly caps. You can split this across multiple ISAs, but exceeding it means the excess becomes taxable; HMRC may penalise over-contributions. What is the limit on a cash ISA? It’s the same £20,000 shared allowance, resetting each tax year from 6 April to 5 April.

To maximise, track deposits carefully—transfers from other ISAs don’t count towards the limit. What is the maximum you can put in a cash ISA this year? Up to £20,000, but consult providers like NatWest for specifics, as detailed in their ISA overview. Average balances hover around £10,000-£12,000 among 14-15 million holders.

- Annual cap: £20,000 total across ISAs

- No minimum deposit for most accounts

- Transfers: Free between same-type ISAs

- Over 18 only for standard accounts

Benefits of a cash ISA

The primary benefit of a cash ISA is tax-free interest, protecting earnings from income tax and helping savers keep more money, especially as UK households poured £103 billion into ISAs in 2023-24 amid economic uncertainty. What is the point of a cash ISA? It offers security via FSCS protection up to £85,000 per provider, plus better rates than non-ISA accounts for higher earners exceeding the personal savings allowance. Compared to regular savings, a cash ISA vs savings account shines in tax efficiency, though rates may be similar.

It’s worth it for low-risk growth; for instance, on £10,000 at 4% interest, you’d save £40 in tax annually for higher-rate payers. Explore comparisons on MoneySuperMarket’s cash ISAs page. Unlike stocks and shares ISAs, cash versions avoid market volatility.

Current cash ISA interest rates in 2025

Top cash ISA rates in 2025 reach 4.45% AER for easy access and fixed terms, influenced by Bank of England base rates and competition among providers. What is the interest rate on a cash ISA? It varies: variable rates fluctuate, while fixed ones guarantee returns, with Trading 212 offering 4.51% as a standout. A good cash ISA rate exceeds 4%, but check live figures as they change.

Factors include term length and access level; for example, a one-year fixed might yield higher than instant access. Providers like Virgin Money and NatWest compete, but for the best cash ISA options, review community feedback. See updated tables on MoneySavingExpert’s best cash ISA guide for 2025/26.

Frequently asked questions

How does a cash ISA work?

A cash ISA works by letting you deposit money into a tax-sheltered account where interest accrues without UK income tax deductions, managed by HMRC rules. You choose a provider, fund it via bank transfer, and interest compounds daily or monthly, paid tax-free. It’s straightforward for beginners, but remember the £20,000 annual limit applies across all your ISAs to avoid penalties.

What is the difference between a cash ISA and a regular savings account?

The key difference is tax treatment: a cash ISA shields interest from tax, while regular savings accounts tax interest above the personal savings allowance (£1,000 for basic-rate taxpayers). Cash ISAs often offer competitive rates but with ISA-specific rules like the annual cap, whereas regular accounts have no such limits but expose earnings to tax. For low savers under the allowance, the difference is minimal, but cash ISAs excel for larger sums or higher earners.

Can I withdraw money from a cash ISA?

Yes, withdrawals are possible depending on the type: easy access cash ISAs allow instant removal without penalty, while fixed-rate ones may charge fees or restrict until term end. Flexible cash ISAs let you replace withdrawn funds within the tax year without using more allowance. Always check provider terms, as unauthorised early access could mean losing tax benefits or facing charges.

What is the ISA allowance for 2025/26?

The ISA allowance for 2025/26 remains £20,000, unchanged from prior years and shared across cash, stocks, and other ISA types. This covers new contributions only; existing savings aren’t affected. Exceeding it turns excess into taxable savings, so track via your provider or HMRC app for compliance.

Is a cash ISA worth it?

A cash ISA is worth it if you pay tax on interest or want guaranteed, low-risk growth, especially with rates up to 4.5% in 2025 outpacing inflation. For beginners, it builds tax-efficient habits without stock market risks, though if you’re under the personal savings allowance and rates are low, a regular account might suffice. Weigh against goals: it’s ideal for emergency funds but less so for high-growth needs.

What is a Lifetime ISA vs cash ISA?

A Lifetime ISA (LISA) is a cash ISA variant for 18-39 year-olds saving for a first home or retirement, with a 25% government bonus on up to £4,000 annually (within the £20,000 total allowance). Standard cash ISAs lack this bonus but offer full flexibility without withdrawal penalties before age 60. LISAs penalise non-qualifying withdrawals (25% charge), making them strategic for long-term goals versus everyday cash ISA use.

What happens if I exceed the ISA limit?

Exceeding the £20,000 ISA limit means the surplus is treated as non-ISA savings, subject to tax on interest via your personal allowance. HMRC voids the excess portion of the ISA, potentially requiring repayment and tax declaration. To avoid this, monitor contributions closely and use transfers for existing ISA funds, which don’t count towards the cap.