What is a Junior ISA?

A Junior ISA, or JISA, is a tax-free savings or investment account designed for children under 18 in the UK, helping parents and guardians build a financial nest egg for their child’s future. It allows contributions up to the annual limit without incurring income tax or capital gains tax on the growth.

Eligibility and rules

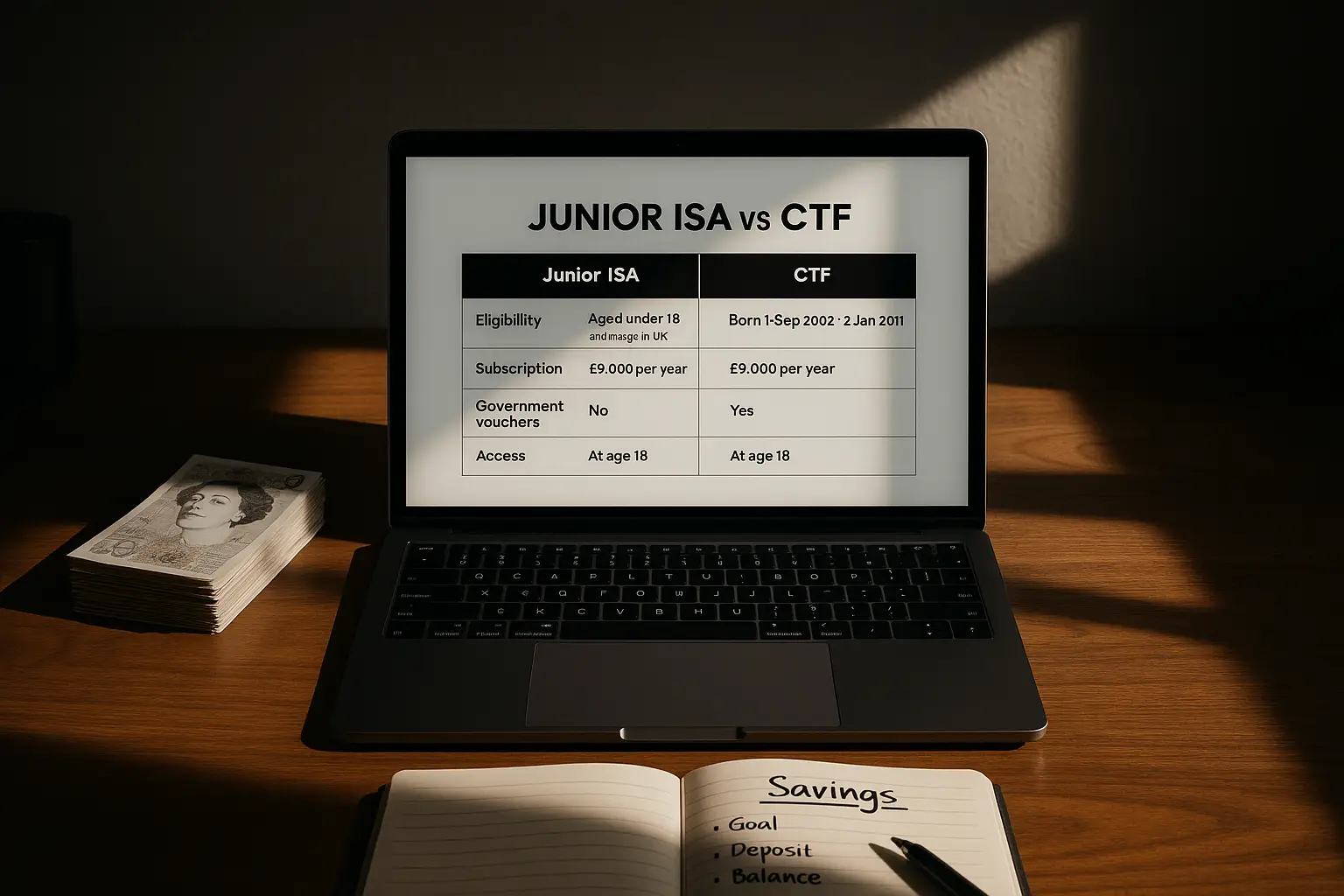

To open a best junior ISA, the child must be a UK resident under 18 and not have a child trust fund. Only parents or legal guardians can open and manage the account, and you can only hold one Junior ISA of each type at a time. Transfers between providers are allowed, but the child cannot access funds until they turn 18, at which point control passes to them. For official rules, see the HMRC guidance on Junior ISAs.

Tax benefits

Junior ISAs are tax-free, meaning any interest, dividends, or gains are exempt from UK taxes, which is a key advantage over regular savings accounts where tax might apply on larger balances. This makes them ideal for long-term growth, as compounding happens without deductions. Unlike adult ISAs, there’s no flexibility to withdraw and replace funds within the tax year.

Allowance limits

The annual Junior ISA allowance for the 2025/26 tax year is £9,000, as confirmed by The Guardian’s guide on Junior ISAs. You can contribute up to this amount across cash and stocks and shares types combined, and unused allowance doesn’t roll over. Gifts from grandparents or others count towards this limit.

Types of Junior ISAs

Cash vs stocks and shares

Cash Junior ISAs work like a savings account, offering steady interest with low risk, while stocks and shares Junior ISAs invest in funds, shares, or ETFs for potentially higher returns but with market volatility. The best junior cash ISA suits cautious savers, whereas the best junior stocks and shares ISA appeals to those comfortable with risk for greater long-term growth.

Key differences

Cash options provide guaranteed returns based on interest rates, protected up to £85,000 per person by the Financial Services Compensation Scheme (FSCS, a safety net for savers if the provider fails). Stocks and shares involve no guarantees, with value fluctuating daily, but they offer diversification through investments like the best ETF for junior ISA, such as a Vanguard S&P 500 tracker. Both are tax-free, but cash is simpler for beginners.

Risk and return profiles

Cash Junior ISAs have low risk and returns around 4-5% currently, while stocks and shares can average 7% historically but may lose value short-term. For example, investing £50 monthly in a stocks and shares account at 7% could grow to £18,000 by age 18, per The Guardian. Always consider your risk tolerance; low-risk cash protects capital, high-risk investments aim for wealth building.

Best cash Junior ISAs 2025

Top rates providers

The best junior cash ISA rates in 2025 reach up to 4.92% AER, led by providers like Plum and Coventry Building Society, according to MoneySavingExpert’s top Junior ISA picks. These variable rates are easy access, meaning you can withdraw anytime without penalty, ideal for flexible saving. Check for minimum deposits, often starting at £1.

Comparison table

| Provider | Interest Rate (AER) | Minimum Deposit | FSCS Protected |

|---|---|---|---|

| Plum | 4.92% | £0.01 | Yes |

| Coventry Building Society | 4.80% | £1 | Yes |

| Virgin Money | 4.50% | £1 | Yes |

| NS&I | 4.20% | £1 | Government-backed |

Rates as of October 2025; subject to change.

Pros and cons

Pros of the best junior cash ISA include security and predictable income, perfect for short-term goals. Cons are lower returns compared to inflation or stocks, potentially eroding purchasing power over 18 years. They’re straightforward but may not maximise growth for the best junior ISA returns.

Tip: Maximise your contributions

Start small if needed, but aim to use the full £9,000 allowance annually to leverage compound interest tax-free. Review rates every six months, as the best junior cash ISA rates can fluctuate with the Bank of England base rate.

Best stocks and shares Junior ISAs 2025

Top platforms

Hargreaves Lansdown tops the list for the best junior stocks and shares ISA with fees under 0.45% and a wide fund selection, as rated by Trust Intelligence’s 2025 review. AJ Bell and Interactive Investor follow, offering low-cost trading and ready-made portfolios. These platforms suit UK parents seeking the best junior ISA providers for diversified investments.

Recommended funds/ETFs

Consider the best funds for junior ISA like Vanguard LifeStrategy or an S&P 500 ETF for global exposure, balancing growth and moderate risk. Ethical options, such as sustainable funds from Royal London, address gaps in some guides. Past performance isn’t a guarantee, but historical averages support long-term potential.

Fee structures

Fees typically include platform charges (0.25-0.45%), fund costs (0.1-1%), and no dealing fees on some. Hargreaves Lansdown keeps total costs low for funds, making it cost-effective for the best junior ISA funds. Always compare; lower fees compound savings over time.

How to choose the best Junior ISA

Factors to consider

Assess risk appetite, time horizon (18 years allows recovery from dips), and fees when picking the best junior ISA UK options. For low risk, opt for cash; for growth, stocks and shares. Diversification and FSCS protection are essential.

Martin Lewis tips

Martin Lewis, via MoneySavingExpert, recommends shopping for the best junior ISA rates and starting early for compounding. He advises against high-risk picks without research and suggests ethical funds if values align. Follow his guidance for the Martin Lewis best junior ISA choices.

Calculator example

Using a simple projection: £50 monthly into a cash Junior ISA at 4.5% yields about £13,500 by age 18. The same in stocks at 7% reaches £18,000, illustrating the best junior ISA returns potential (source: The Guardian). Use online calculators for personalised figures; remember, investments can fall.

Junior ISA rules and access

When child can withdraw

Funds are locked until the child turns 18, then they control the account and can withdraw freely, converting to an adult ISA if desired. Early access is only possible in exceptional cases, like terminal illness, with HMRC approval.

Transfer options

You can transfer between providers without losing tax-free status, useful for better rates or funds. It’s free in most cases, but check for exit fees. This flexibility helps maintain the best junior ISA accounts over time.

Common mistakes

Avoid exceeding the £9,000 limit, which voids tax benefits, or ignoring fees that eat returns. Not reviewing annually or choosing mismatched risk levels are pitfalls. Over 1.2 million accounts hold average £4,500 balances (UK StockBrokers.com, 2024—update via HMRC).

Frequently asked questions

What is a Junior ISA?

A Junior ISA is a tax-efficient savings vehicle for UK children under 18, allowing tax-free growth on contributions up to £9,000 annually. Parents manage it until the child reaches 18, when it becomes accessible. It’s distinct from adult ISAs, focusing on long-term child savings without tax on interest or gains, making it a cornerstone for the best junior ISA strategies.

How much can I contribute to a Junior ISA?

The 2025/26 allowance is £9,000 total across cash and stocks types, non-rolling. Contributions can come from anyone, but exceed this and you’ll face tax penalties. For beginners, even small amounts like £50 monthly compound significantly, as shown in growth examples from trusted sources like The Guardian.

What’s the difference between cash and stocks and shares Junior ISAs?

Cash Junior ISAs offer secure, interest-based savings with FSCS protection, ideal for low-risk profiles and the best junior cash ISA rates around 4.92%. Stocks and shares involve market investments for higher potential returns but volatility, suiting the best junior stocks and shares ISA for growth-oriented parents. Choose based on risk; hybrids aren’t available, but transfers are.

Are Junior ISAs tax-free?

Yes, all growth in a Junior ISA is exempt from UK income tax, capital gains tax, and dividend tax, regardless of amount. This contrasts with regular accounts where tax applies above personal allowances. It’s a major draw for the best junior ISA UK, ensuring maximum compounding for your child’s future.

What is the best Junior ISA rate in 2025?

Top cash rates hit 4.92% from providers like Plum, per MoneySavingExpert updates. For stocks, focus on low-fee platforms like Hargreaves Lansdown (under 0.45%) for optimal net returns. Rates vary; compare the best junior ISA rates regularly, as economic changes impact them, and remember past performance isn’t indicative of future results.

Is a Junior ISA better than a regular savings account?

For tax-free growth, yes—Junior ISAs shield earnings, unlike taxable kids’ savings over £100 interest annually. However, regular accounts might offer higher rates short-term without investment risk. For long-term, the best junior ISA provides superior compounding; consult Martin Lewis tips for personalised comparison, weighing accessibility and protection.

What are the best funds for a Junior ISA?

Low-cost index funds like Vanguard’s global ETF or S&P 500 trackers are popular for the best junior ISA funds, offering diversification and historical 7% returns. Ethical options from providers like AJ Bell add sustainability. Advanced users should balance fees and risk; professional advice helps tailor to goals, avoiding over-concentration in one sector.

This article is for informational purposes only and not financial advice. Consult a qualified advisor or the FCA for personal recommendations. Start saving today by comparing providers and opening a best junior ISA to secure your child’s future.